1. Goods available for sale are $350,000; beginning inventory is $24,000; ending inventory is $32,000; and cost of goods sold is $275,000. The inventory turnover is

A. 9.82.

B. 12.50.

C. 8.59.

D. 11.46.

2. Committing a fraud because the employee feels that it will be easy to do is indicative of which part of the fraud triangle?

A. Perceived pressure

B. Perceived opportunity

C. Rationalization

D. Realization

3. A company has $8,200 in net sales, $1,100 in gross profit, $2,500 in ending inventory, and $2,000 in beginning inventory. The company's cost of goods sold is

A. $7,100.

B. $6,200.

C. $5,600.

D. $5,700.

4. Goods available for sale are $118,000; beginning inventory is $37,000; ending inventory is $42,000; and cost of goods sold is $77,000. The inventory turnover is

A. 2.99.

B. 1.83.

C. 1.95.

D. 1.53.

5. Committing a fraud because the employee feels "I deserve a pay raise. The company owes this to me is indicative of which part of the fraud triangle?

A. Realization

B. Perceived opportunity

C. Perceived pressure

D. Rationalization

6. Which of the following would probably not cause inventory shrinkage?

A. Employee theft

B. Spoilage of items

C. Spills of items

D. Correct counting of all inventory

7. One of the biggest factors in implementing SOX was

A. disclosing deficiencies in internal controls.

B. reviewing the financial reports.

C. the cost of implementing the system.

D. establishing internal control procedures.

8. When a merchandiser sells on account, which of the following is not needed to record the transaction?

A. Inventory

B. Cash

C. Cost of goods sold

D. Accounts receivable

9. New technology, like the latest cell phones and HDTV, would probably be costed using the

A. moving-average method of inventory costing.

B. FIFO method of inventory costing.

C. specific-identification method of inventory costing.

D. LIFO method of inventory costing.

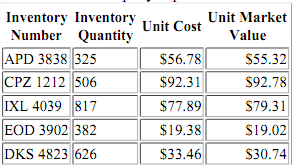

10. Meranda Company reports the following inventory information:

What is the total value of the merchandise under LCM (lower-of-cost or market)?

A. $158,545.60

B. $157,147.60

C. $154,832.90

D. $156,230.80

11. A company's current ratio increased from 1.23 to 1.45. What does this mean?

A. There isn't enough information to explain the increase.

B. This means that current assets increased and current liabilities increased.

C. This means that current assets decreased and current liabilities decreased.

D. This means that current assets increased and current liabilities decreased.

12. A low gross profit percentage means that

A. the cost of goods sold was relatively high.

B. general and administrative expenses are very high.

C. the cost of goods sold was relatively low.

D. selling expenses are very low.

13. If current assets decrease and current liabilities increase, the current ratio

A. will change based on the change in total assets.

B. remains the same.

C. increases.

D. decreases.

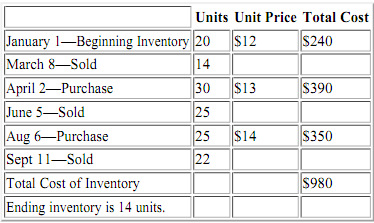

14. Casey Company's beginning inventory and purchases during the fiscal year ended December 31, 2012, were as follows: (Note: The company uses a perpetual system of inventory.)

What is the cost of goods sold for Casey Company for 2012 using LIFO?

A. $264

B. $801

C. $784

D. $308

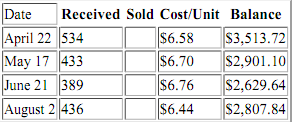

15. Isaiah Sporting Goods uses the perpetual average cost method of determining inventory costs. Below is the inventory record for Product C124:

What is the average cost per unit after the receipt of the May 17 inventory (rounded to the nearest cent)?

A. $6.00

B. $6.55

C. $6.63

D. $7.40

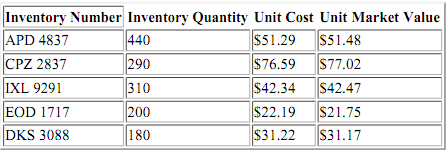

16. Nick Company reports the following inventory information:

What is the total value of the merchandise under LCM (lower-of-cost or market)?

A. $67,961.70

B. $68,210.30

C. $67,864.70

D. $68,113.30

17. Net sales times the historical gross profit percentage yields the estimated

A. beginning inventory.

B. gross profit.

C. ending inventory.

D. cost of goods sold.

18. A company's gross profit percentage decreases from 58% to 51%. What does this mean?

A. We can't determine anything definite from the information given.

B. This means that net income will be lower.

C. This means that there will be a net loss.

D. This means that net income will be higher.

19. Under Sarbanes-Oxley, those officers signing off on the reports must have evaluated the company's internal control within the previous

A. nine months.

B. six months.

C. year.

D. 90 days.

20. A drawback to using _______ when inventory costs are rising is that the company reports lower net income.

A. LIFO

B. specific-identification costing

C. average costing

D. FIFO