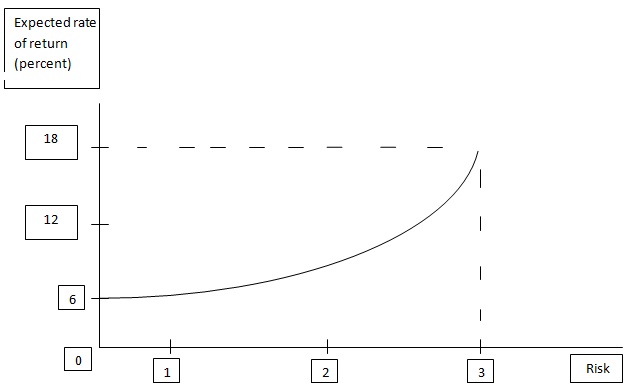

Problem 1: William J. Bryan is the general manager of an electrical assembly plant. He must decide whether to install a number of assembly robots in his plant. This investment would be risky because both management and the workforce have no real experience with the introduction or operation of such robots. His indifference curve between expected rate of return and risk is as shown in the figure.

a. If the riskiness of this investment equals 3, what risk premium does he require?

b. What is the riskless rate of return?

c. What is the risk-adjusted discount rate?

d. In calculating the present value of future profit from this investment, what interest rate should be used?

Problem 2. The Boca Raton Company announces that if it reduces its price subsequent to a purchase, the early customer will get a rebate so that he or she will pay no more than those buying after the price reduction.

a. If the Boca Raton Company has only one rival, and if its rival too makes such an announcement, does this change the payoff matrix? If so, in what way?

b. Do such announcements tend to discourage price cutting? Why or why not?

Problem 3. Your company is bidding for a broadband spectrum license. You have been asked to submit an optimal bidding strategy. You expect that bidders will have independent private values for the licenses because each bidder presently has a different structure in place. You believe the valuations for these licenses will be between $200 million and $700 million. Your own valuation is $650 million.

There is some uncertainty about the auction design that will be used, so you must suggest an optimal bidding strategy for the following auction designs:

a. Second-price, sealed-bid auction.

b. English auction.

c. Dutch auction.