Case Study

Saint-Foods Limited (Ltd) is a Brittany-based snack foods producer that is currently undergoing a major expansion. Saint-Foods Ltd has previously increased plant capacity and undertaken a major marketing campaign in an attempt to "go national." However, despite this, sales have not been up to forecasted level, costs have been higher than projected and a large loss was incurred in 2013 rather than the anticipated expected profit.

As a result, Saint-Foods' managers, directors and investors are concerned about the firm's survival. There are several options available for the board of directors to choose, including cutting costs, providing credit sales, expanding the existing production facilities, and building a new food processing factory.

You are just going to finish your Masters programme from one of the leading business schools in France and have been looking for an employment opportunity in the foods industry since the beginning of March 2014. Luckily, your application was favourably considered by Mr. John Ball, Saint-Foods Ltd's Chairman, who has the task of getting the company back into a sound financial position. Following a positive interview conducted two days ago, you were contacted by Mr. Ball who would like you to provide a report of analysing the company's performance, which could be used to help the board of directors to decide the future actions.

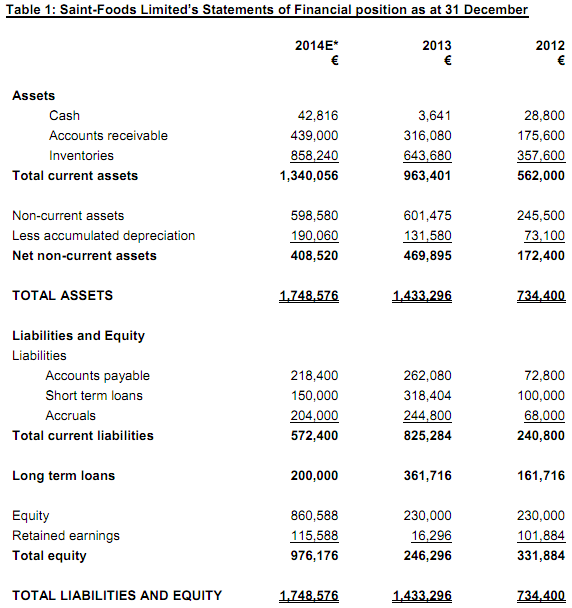

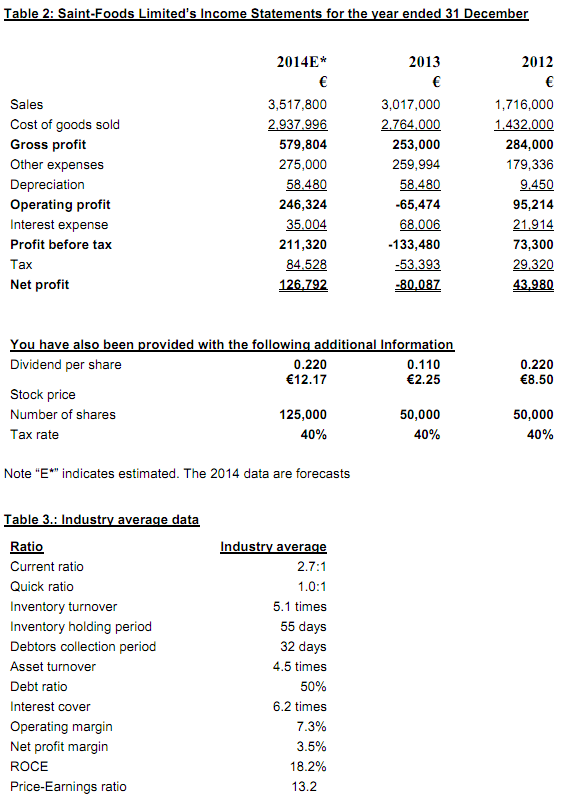

Saint-Foods Ltd's 2012 and 2013 Statements of Financial Position and Income Statements, as well as forecasts for 2014 are shown in Tables 1 and 2 below respectively. You have also been provided with the industry average data shown in Table 3 below. The forecasted financial statement information represents John's best guess for 2014, assuming that some new financing is arranged to get the company "over the hump."

You have examined monthly data for 2013 (not given in this case) and have detected an improving pattern during the year. Monthly sales were rising, costs were falling and although large losses were incurred in early months, a small profit was earned by December. However, the annual data for 2013 looks somewhat worse than final monthly data. Additionally, it appears to be taking longer for the advertising programme to get the message out for new sales office to generate sales and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than what Saint-Foods Ltd's managers had anticipated. For these reasons, you consider there is some hope for the company provided that it can survive in the short run.

Below are the statements of financial position and Income statements for Saint-Foods Ltd for 2012, 2013 and forecasts for 2014.

Required:

Based on the content of the financial statements and other relevant information available to you, you are required to produce a report to the board of directors of Saint-Foods, covering the followings;

a) Use a range of financial ratios to critically evaluate the financial performance of Saint-Foods Ltd. (Include all calculations, workings and formulae used in an appendix to your report).

b) Using all the information at your disposal, critically evaluate the financial performance of Saint-Foods Ltd by analysing where the company is now.

c) Based on your analysis, recommend what Saint-Foods Ltd must do to regain its financial health and what actions should be taken.

d) Critically discuss the applicability of factoring and invoice discounting for Saint-Foods, should the company provide customers with more credit sales, which expects to have a major impact on the company's cash flows.