Case-Study:

“Activity Based Costing (ABC) originally sought to determine better product costs. It has now become focused on cost management and providing strategic guidance.”

Required:

a) To what extent would it be fair to say that Activity Based Costing provides a solution to the problem of overhead allocation?

b) Discuss how ABC may aid in cost management and in considering strategic issues, and whether it is limited by the above conditions.

c) Please read the following case study and critically evaluate the profitability report of the two products.

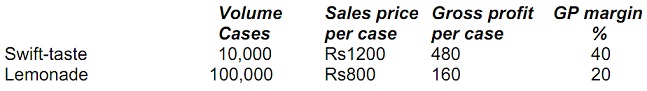

Mauritius Drinks Ltd manufactures soft drinks, namely Swift-taste and Lemonade. Information about the two products is as follows:

It is observed that both products yield the same gross profit margin and that Mauritius Drinks Ltd allocates factory overhead using a traditional product costing approach. The company has used a direct labour hour rate for tracing overheads to products.

At a recent meeting the production manager raised a pertinent point with respect to the GPM of the two products. He is categorical that something is drastically wrong with the company’s present cost allocation system. He provides some additional information about the two products:

Swift-taste: requires extensive process preparation and sterilization prior to processing. The ingredients are imported from Africa, requiring complex import controls. The formulation is complex, and it is difficult to maintain quality. Lastly, the product is sold in small orders.

Lemonade: requires minor process preparation and there is no sterilization prior to processing. The ingredients are acquired locally, the formulation is simple, and it is easy to maintain quality. The drink is sold in large bulk orders.