Response to the following problem:

Jim Anderson works in the production department of Midwest Steelworks as a machine operator. Jim, a long-time employee of Midwest, is paid on an hourly basis at a rate of $20 per hour. Jim works five 8-hour shifts per week Monday-Friday (40 hours). Any time Jim works over and above these 40 hours is considered overtime for which he is paid at a rate of time and a half ($30 per hour). If the overtime falls on weekends, Jim is paid at a rate of double time ($40 per hour). Jim is also paid an additional $20 per hour for any holidays worked, even if it is part of his regular 40 hours. Jim is paid his regular wages even if the machines are down (not operating) due to regular machine maintenance, slow order periods, or unexpected mechanical problems. These hours are considered "idle time."

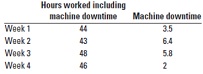

During December Jim worked the following hours:

Included in the total hours worked are two company holidays (Christmas Eve and Christmas Day) during Week 4. All overtime worked by Jim was Monday-Friday, except for the hours worked in Week 3. All of the Week 3 overtime hours were worked on a Saturday.

Required

1. Calculate (a) direct manufacturing labor, (b) idle time, (c) overtime and holiday premium, and (d) total earnings for Jim in December.

2. Is idle time and overtime premium a direct or indirect cost of the products that Jim worked on in December?Explain.