Question: Overhead is applied on the basis of direct labor hours. Three direct labor hours are required for each product unit. Planned production for the period was set at 8,000 units. Manufacturing overhead for the period is budgeted at $204,000, of which 30 percent is fixed. The 26,200 hours worked during the period resulted in production of 8,500 units. Manufacturing overhead cost incurred was $220,500.

Required: Calculate the following three overhead variances.

a) Overhead volume variance.

b) Overhead efficiency variance.

c) Overhead spending variance.

Question: Maidwell Company manufactures washers and dryers on a single assembly line in its main factory. The market has deteriorated over the last five years and competition has made cost control very important. Management has been concerned about the materials costs of both washers and dryers. There have been no model changes in the past two years, and economic conditions have allowed the company to negotiate price reductions for many key parts.

Maidwell uses a standard cost system in accounting for materials. Purchases are charged to inventory at a standard price, and purchase discounts are considered an administrative cost reduction. Production is charged at the standard price of the materials used. Thus, the price variance is isolated at time of purchase as the difference between gross contract price and standard price multiplied by the quantity purchased. When a substitute part is used in production, a price variance equal to the difference in the standard prices of the materials is recognized at the time of substitution. The quantity variance is the actual quantity used compared with the standard quantity allowed, with the difference multiplied by the standard price.

The materials variances for several of the parts Maidwell uses are unfavorable. Part #4121 is one item that has an unfavorable variance. Maidwell knows that some of these parts are defective and will fail. The failure is discovered during production. The normal defective rate is 5 percent of normal input. The original contract price of this part was $0.285 per unit; thus, Maidwell set the standard unit price at $0.285. The unit contract purchase price of Part #4121 was increased to $0.325 from the original $0.285 due to a parts specification change. Maidwell chose not to change the standard; it treated the increase in price as a price variance. In addition, the contract terms were changed from payment due in 30 days to a 4 percent discount if paid in 10 days or full payment due in 30 days. These new contractual terms were the consequence of negotiations resulting from changes in the economy.

Data regarding the use of Part #4121 during December are as follows.

• Purchases of Part #4121: 150,000 units

• Unit price paid for purchases of Part #4121: $0.325

• Requisitions of Part #4121 from stores for use in products: 134,000 units

• Substitution of Part #5125 for Part #4121 to use obsolete stock (standard unit price of Part #5125 is $0.35): 24,000 units

• Units of Part #4121 and its substitute (Part #5125) identified as defective: 9,665 units

• Standard allowed usage (including normal defective units) of Part #4121 and its substitute based on output for the month: 153,300 units

Maidwell's material variances related to Part #4121 for December were reported as follows:

Price variance $7,560.00U

Quantity variance 1,339.50U

Total materials variances for Part #4121 $8,899.50U

Bob Speck, the purchasing director, claims the unfavorable price variance is misleading. Speck says that his department has worked hard to obtain price concessions and purchase discounts from suppliers. In addition, Speck says engineering changes in several parts have increased their prices, even though the part identification has not changed. These price increases are not his department's responsibility. Speck declares that price variances no longer measure purchasing performance.

Jim Buddle, the manufacturing manager, thinks the responsibility for the quantity variance should be shared. Buddle states that manufacturing cannot control quality associated with less expensive parts, substitutions of material to use up otherwise obsolete stock, or engineering changes that increase the quantity of materials used.

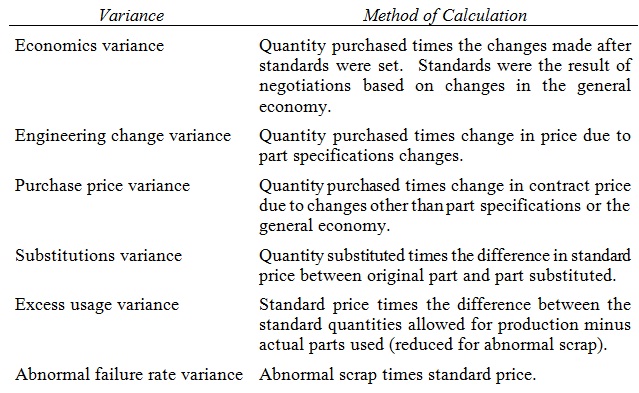

The accounting manager, Mike Kohl, suggests that the computation of variances be changed to identify variations from standard with the causes and functional areas responsible for the variances. Kohl recommends the following system of materials variances and the method of computation for each:

Required:

a) Discuss the appropriateness of Maidwell Company's current method of variance analysis for materials and indicate whether the claims of Bob Speck and Jim Buddle are valid.

b) Compute the materials variances for Part #4121 for December using the system recommended by Mike Kohl.

c) Who would be responsible for each of the variances in Mike Kohl's system of variance analysis for materials?