Question:

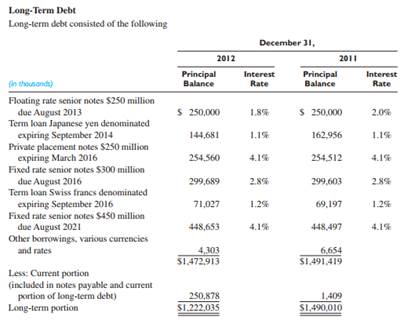

The following information was taken from the 2012 financial statements of Dentsply International, a company that develops, manufactures, and markets medical equipment and supplies for the global dental market.

The Company has a $500.0 million five-year revolving credit agreement with participation from 16 banks, which expires in July 2016. The revolving credit agreement contains a number of covenants and two financial ratios, which the Company is required to satisfy. The most restrictive of these covenants pertain to asset dispositions and prescribed ratios of indebtedness to total capital and operating income excluding depreciation and amortization to interest expense. Any breach of any such covenants or restrictions would result in a default under the existing borrowing documentation that would permit the lenders to declare all borrowings under such documentation to be immediately due and payable and, through cross default provisions, would entitle the Company’s other lenders to accelerate their loans. At December 31, 2012, the Company was in compliance with these covenants.

The term loans and private placement notes (“PPN”) contain certain affirmative and negative covenants relating to the Company’s operations and financial condition. At December 31, 2012, the Company was in compliance with all debt covenants. At December 31, 2012, the Company had total unused lines of credit, including lines available under its short-term arrangements and revolving credit agreement, of $527.4 million. The table below reflects the contractual maturity dates of the various borrowings at December 31, 2012 (in thousands):

2013 $250,878

2014 221,865

2015 102,230

2016 448,440

2017 442

2018 and Beyond 449,913

$1,472,973

Required:

1. Exhibit 11.10 in this chapter reproduces excerpts from Dentsply’s 2009 financial statement note for long-term debt. How has the amount and composition of the company’s long-term borrowing changed between 2009 and 2012?

2. How have the interest rates charged on Dentsply’s long-term debt changed between 2009 and 2012? Explain why (or why not) these changes are indicative of Dentsply’s decreased credit risk.

3. Comment on the future cash flow implications of the change between 2009 and 2012 in the contractual maturity dates of Dentsply’s various borrowings.

4. Calculate the weighted-average rate of interest on the company’s long-term debt as of December 31, 2012. You should ignore “Other borrowings, various currencies and rates.”

5. Based on your answer to requirement 4, estimate the amount of interest expense Dentsply will record in 2013.

6. How much cash will the company pay out to debt holders in 2013?