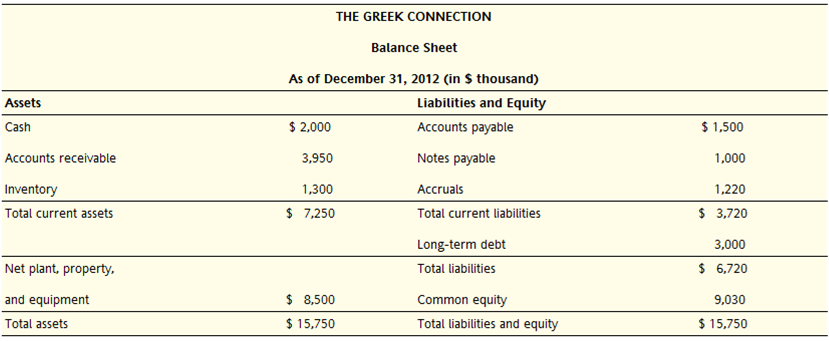

Q1. The Greek Connection had sales of $32 million in 2012, and a cost of goods sold of $20 million.

a. Calculate The Greek Connections net working capital in 2012.

b. Calculate the cash conversion cycle of The Greek Connection in 2012.

c. The industry average accounts receivable days is 30 days. What would the cash conversion cycle for The Greek Connection have been in 2012 had it matched the industry average for accounts receivable days?

Q2. Assume the credit terms offered to your firm by your suppliers are 3/5, Net 30. Calculate the cost of the trade credit if your firm does not take the discount and pays on day 30.

Q3. Your supplier offers terms of 1/10, Net 45. What is the effective annual cost of trade credit if you choose to forgo the discount and pay on day 45?

Q4. The Manana Corporation had sales of $60 million this year. Its accounts receivable balance averaged $2 million. How long, on average, does it take the firm to collect on its sales?

Q5. Your firm purchases goods from its supplier on terms of 3/15, Net 40.

a. What is the effective annual cost to your firm if it chooses not to take the discount and makes its payment on day 40?

b. What is the effective annual cost to your firm if it chooses not to take the discount and makes its payment on day 50?

Q6. Which of the following short-term securities would you expect to offer the highest before-tax return: Treasury bills, certificates of deposit, short-term tax exempts, or commercial paper? Why?