Taxable income given; calculate deferred tax liability

LO16-1

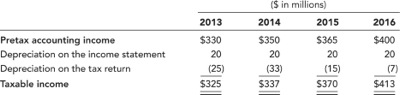

Ayres Services acquired an asset for $80 million in 2013. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 40%. Amounts for pretax accounting income, depreciation, and taxable income in 2013, 2014, 2015, and 2016 are as follows:

Required:

For December 31 of each year, determine (a) the temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account.