Question 1

We currently have two accounting issues. Could you please provide us with accounting advice for each issue. Please reference any relevant Australian Accounting Standards (AASB) in your letter, so we can show our external auditors at year end.

1. We have recently started offering our customers an after sales service on any computer equipment they purchase. Each customer is given one day per month of training on the latest Microsoft packages for the following twelve months, which is included in the sales price of the computer. The total sales price for each computer is $1,628 (including GST). This amount also includes the yearly service fee for computer training which is 5480. The customer is required to pay the full price of 51,628 at the time of purchase.

We are not sure how to rneasure this revenue both at the time of the sale and also after we have provided the monthly service. Please reference any relevant Australian Accounting Standards (AAS8) in your advice, applied to the facts provided and also supply the relevant journals to record both transactions in the Appendix.

2. We are considering changing our business structure to a company. We both own a large amount of personal assets and think this might be a good idea. We also need to raise some finances for our next project, but are uncertain how to do this under a company structure. What advise can you give us?

Question 2

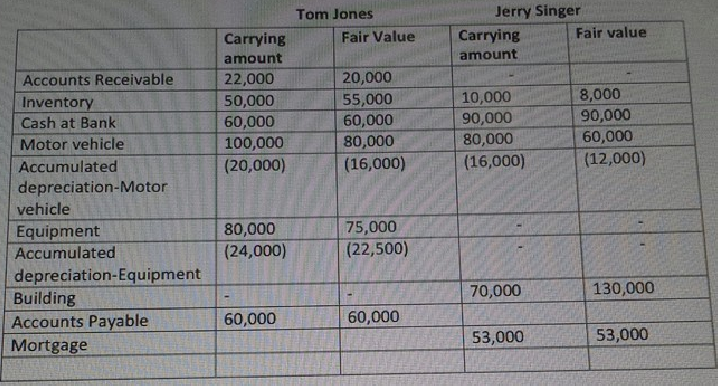

Tom Jones and terry Singer decided to enter into a partnership agreement as at 1 July 2014, the fair value and carrying amounts of the assets contributed by each partner and liabilities assumed by the partnership are as follows:

Required:

(a) Prepare separate general journal entries (including narrations) to record the formation of the partnership as at 1 July 2014. Ignore GST.

(b) During the year ended 30th June 2015, the partnership for Tom and Jerry earned a profit of $140,000. Interest is paid on opening capital balances of 10% and profits or losses are to be shared in the same proportions as capital contributed. Torn was paid a salary of $25,000. No salary was paid to Jerry. Use the capital balances calculated in (a) above.

(c) Prepare the two journals required to record the profit allocation as at 30th June 2015, using method 2.

Question 3 - Accounting for income Tax

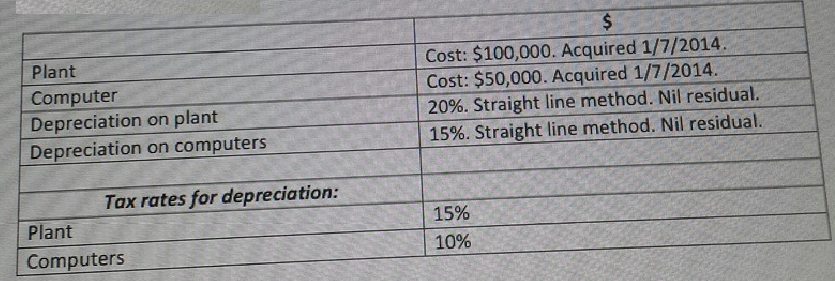

(a) Calculate the carrying amount and the tax base for plant and computers as at 30th June 2015.

(b) Calculate the total temporary difference in (a) above, assuming a 30% tax rate. In your answer explain which account this would be recorded in and why.