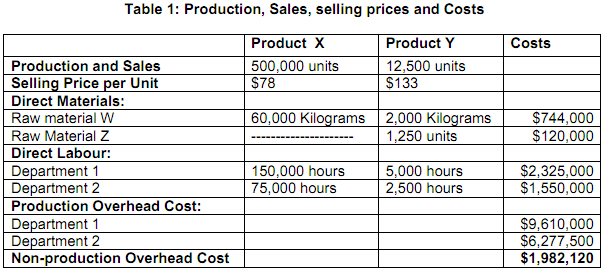

Beta Company Ltd manufactures two products (product X & product Y) in two production departments (Department 1 & Department 2). Product X is a simple, high-volume product and product Y is a complex, low-volume product. Both products are processed in departments 1 and 2. Product X uses only one raw material (W), but product B uses two raw materials (W and Z). Table 1 provides data on the production, sales, selling prices and costs incurred for the last year ended 30 June 2012.

Under the traditional costing system Beta Company Ltd allocated production overhead cost to products using departmental overhead rates based on direct labour hours (for both departments). Non-production overhead cost was absorbed on a sales volume basis.

The Manager (Mr Ahmed) argues that traditional costing ignores the different complexity of products X and Y as it allocates production and non-production overhead cost based on volume-based overhead application rates such as direct labour and sales volume.

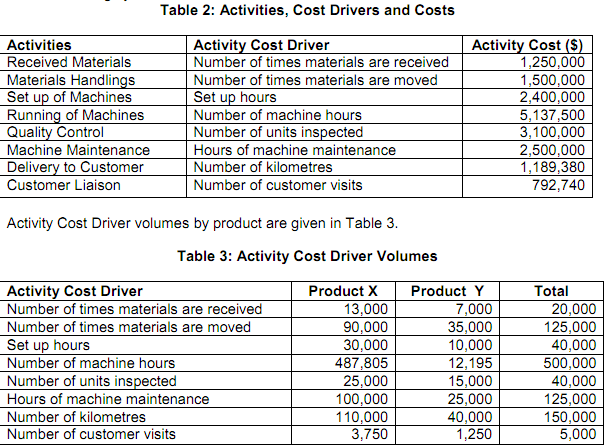

Beta Company Ltd attempts to overcome the problem of cost distortions resulting from the traditional costing system. They consider introducing the ABC costing system that attributes costs to products based on the activities they demand. Table 2 presents the activities, cost drivers and costs identified by Beta Company Ltd's management accountants for applying the ABC costing system.

Required:

(a) Calculate full unit cost for products X and Y under the traditional costing system.

(b) Calculate full unit cost for products X and Y under the new activity-based costing (ABC) system.

(c) Calculate the difference between the full unit cost for products X and Y calculated under the traditional costing system and that calculated under the ABC costing system.

(d) Explain the differences calculated in (c) above for both products.

(e) Calculate the difference between product costs of both products and their respective current selling prices based on the traditional costing system.

(f) Calculate the difference between product costs of both products and their respective current selling prices based on the ABC costing system.

(g) Identify and explain to Mr Ahmed the possible advantages and disadvantages of adopting the ABC costing system.