1. On January 1, 2012, St. John Corp. purchased a new truck for $35,000. St. John determined that this truck would be useful for 150,000 miles at which time it would have a salvage value of $5,000. During the next three years the truck was driven for 25,000, 20,000, and 28,000 respectively. At the beginning of the fourth year (2015), St. John had to overhaul the truck's engine at a cost of $7,000. The overhaul increased the life of the truck by adding 20,000 miles of use. During the fourth year the truck was driven for 23,000 miles.

Required:

a) Calculate depreciation expense for the first three years. (2012, 2013, 2014)

b) Calculate depreciation expense for 2015. (Round to three decimals for calculating. Final answer should be rounded to nearest dollar.)

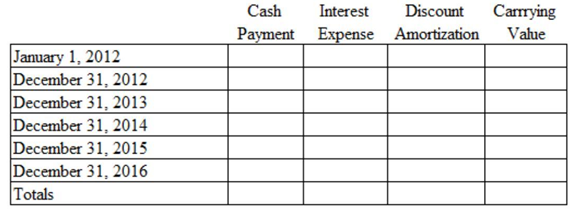

2 . Villarente Company issued 5-year $200,000 face value bonds at 95 on January 1, 2012. The stated interest rate on these bonds is 9%, and the effective interest rate is 10.33%. Use the effective interest rate method to complete the amortization schedule below. (Round all calculations to nearest dollar, i.e. do not show any decimals in table. You need to round the entries on 12/31/16. As check figures, total interest expense should be $100,000 and total discount amortization should be $10,000)