Comprehensive problem on amortization of long lived assets

On 1st January 2006, Maple Leaf Corporation reported the following property, plant, equipments and other intangible assets.

Assets Cost Estimated life Salvage value Accumulated amortization

Land 4500000 N.A. Nil

Building 6000000 40 years Nil 3300000

Equipment 2000000 10 years Nil 1250000

Goodwill 370000 N.A. Nil

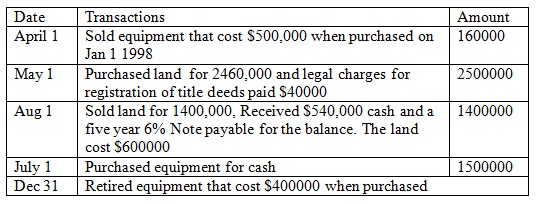

During 2006 following transactions occurred.

Instructions:

1) Calculate amount of amortization expense for 2006 in respect of each asset given above and impairment loss in respect of Goodwill.

2) Record journal entries for the above transactions

3) Record adjusting entries at Dec 31 2006.

4) Prepare Property, plant and equipment section of the partial Balance sheet at December 31 2006..