Question 1: Bond Prices and Yields:

Assumed that the Financial Management Corporation’s $1,000 par-value bond had a 5.700% coupon, matured on May 15,2020, had a current price quote of 97.708, and had a yield to maturity of 6.034%. Given this information, answer the following questions:

A. What was the dollar price of the bond?

($1,000 * .97708) = $977.08

B. What is the bonds current yield?

[(.05700 * $1,000)/$977.08] = 5.83%

C. Is the bond selling at par, at a discount, or at a premium?

This particular bond is selling at a Discount since: Coupon < Current Yield < YTM.

D. Compare the bonds current yield calculated in part B to its YTM and explain why they differ.

Question 2: Basic Bond Valuation:

Complex Systems has an outstanding issue of $1,000 par-value bonds with a 12% coupon interest rate. The issue pays interest annually and has 16 years remaining to its maturity date.

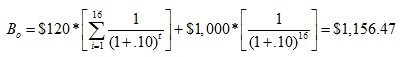

A. If bonds of similar risk are currently earning a 10% rate of return, how much should the Complex Systems bond sell for today?

B. Describe two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond.

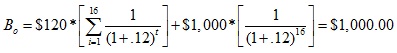

C. If the required rate of return were at 12% instead of 10%, what would the current value of Complex Systems bond be? Contrast this finding with you findings in part A.

Question 3: Yield to Maturity:

The Salem Company bond currently sells for $955, has a 12% coupon interest rate and a $1,000 par-value, pays interest annually, and has 15 years to maturity.

A. Calculate the yield to maturity (YTM) on this bond.

For calculating this I used an Excel spreadsheet and the IRR function as shown in the textbook. Since there is a 12% coupon rate, we know that there will be an annual cash flow of $120. The YTM for this particular bond is 13.0%

B. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond.