BINARY CHOICE QUESTIONS (14 QUESTIONS)

Question 1. Suppose a market is initially in equilibrium. At this equilibrium the absolute value of the price elasticity of demand is larger than the absolute value of the price elasticity of supply. If the government imposes an excise tax, then a larger fraction of tax revenue comes out of the _______ surplus.

a. Consumer

b. Producer

Question 2. Economists can be so obsessive about signs and percentages. Which of the following statements best captures why economists have developed the arc price elasticity of demand formula?

(I) Percentages are so unreliable since your choice of starting point can generate different measures: let’s alter the formula so that the calculation is always a positive number.

(II) Percentages using the same set of numbers can be different depending upon choice of starting point: let’s alter the formula to stabilize our measure so that choice of starting point is immaterial.

a. Statement I is the best statement about the arc elasticity formula.

b. Statement II is the best statement about the arc elasticity formula.

Question 3. If marginal cost is below average total cost as output increases, then average total cost is

a. Decreasing as output increases.

b. Increasing as output increases.

Use the following information to answer the next TWO (2) questions

Demand and supply in the market for silver plates are given by the following equations where P is the price per silver plate and Q is the quantity of silver plates:

Supply: PS = Q

Demand: PD = 200 - Q

Question 4. If the government imposes an excise tax of $10, what price will consumers pay?

a. $105 per silver plate

b. $110 per silver plate

Question 5. What is the government's tax revenue under the $10 excise tax?

a. $1000

b. $950

Question 6. Consider a small economy currently closed to trade in the market for wine. The domestic market price is currently below the international price. If the small economy opens to trade with the rest of the world in the wine market, the consumer surplus will ______ and producer surplus will ______.

a. Increase; Decrease

b. Decrease; Increase

Question 7. Karl runs a factory in a perfectly competitive industry. His engineers tell him his last unit of output cost $50 to produce. The market price for this product is currently $100. Given this information and holding everything else constant, then Karl should

a. Increase the production of this product.

b. Decrease the production of this product.

Question 8. The income elasticity of demand for a product is -2. Then if income decreases by 10%, the quantity demanded for this product

a. Increases by 20%.

b. Decreases by 5%.

Question 9. Attia can consume olives and wine and has "bowl shaped" (i.e. smooth) indifference curves over these goods. At her current consumption bundle her marginal utility of an extra olive is 2, her marginal utility of an extra cup of wine is 5, the price of an olive is $1 and the price of a cup of wine is $2.50. Atia is also spending all her income. Given this information and holding everything else constant, is Atia maximizing her utility at her current consumption bundle?

a. Yes

b. No

Question 10. The following table contains data on various percentiles of the salary distribution of two occupations, statistician and professional athlete. Which occupation will give you the higher salary, assuming you are both an "about average" statistician and an "about average" professional athlete?

|

|

Exactly 10% of workers earn less than |

Exactly 25% of workers earn less than |

The median worker earns |

Exactly 75% of workers earn less than |

Exactly 90% of workers earn less than |

|

|

|

Statistician |

$50,000 |

$75,000 |

$100,000 |

$125,000 |

$150,000 |

|

|

|

Professional athlete |

$20,000 |

$35,000 |

$65,000 |

$150,000 |

$5,000,000

|

|

|

|

|

|

|

|

|

|

|

|

a. Statistician

b. Professional athlete

Question 11. You have been given information about the cost of a typical consumption basket in the years 1990, 2000 and 2010. The cost of the basket went up between 1990 and 2000 and also went up between 2000 and 2010. Then if we use 2000 as the base year,

a. Real prices (in year 2000 dollars) in 1990 will be lower than nominal prices in 1990.

b. Real prices (in year 2000 dollars) in 1990 will be higher than nominal prices in 1990.

Question 12. Consider a perfectly competitive market in which all firms have identical cost curves. Firms will stop entering or exiting the market when the market price reaches the ______ of the representative firm.

a. Shut-down price

b. Break-even price

Question 13. You are running a gummy bear factory and know that the cross price elasticity of gummy bears with respect to the price of whiskey is negative. If you see that the price of whiskey increases then you should anticipate that the demand for gummy bears will

a. Increase.

b. Decrease.

Question 14. Ray enjoys consuming cheese curds with beer. However, Ray is very particular about his eating habits: he only drinks a glass of beer if he has an ounce of cheese curds to go with it, and vice versa. Then glasses of beer and ounces of cheese curds are ______ for Ray.

a. Perfect complements

b. Perfect substitutes

MULTIPLE CHOICE QUESTIONS (20 QUESTIONS)

Question 15. A market is initially in equilibrium and in this market there has been no government intervention. Then the government imposes an excise tax. Under which of the following conditions will the price consumers pay under the excise tax exactly equal the previous market price plus the excise tax amount?

a. This described outcome occurs when supply is upward sloping.

b. This described outcome occurs when demand is perfectly inelastic.

c. This described outcome is always the outcome with an excise tax.

d. This described outcome can never happen.

Question 16. Suppose the demand for fried chicken is given by Q = 1900 - 45P. The point price elasticity at P = 20 is

a. 2

b. -0.5

c. 0.5

d. 0.9

Question 17. The consumers living in New York City have observed inflation of 10% every year. The average nominal wage in 2013 was $10 per hour. In 2014 the average wage is $10.50 per hour. Then

a. The average New Yorker is better off in 2014 since the average New Yorker’s purchasing power has increased.

b. The average New Yorker is worse off in 2014 since the average New Yorker’s purchasing power has decreased.

c. The average New Yorker is neither worse off nor better off in 2014.

d. It is impossible to make a prediction about the plight of the average New Yorker’s real wage given this information.

Use the following information to answer the next THREE (3) questions.

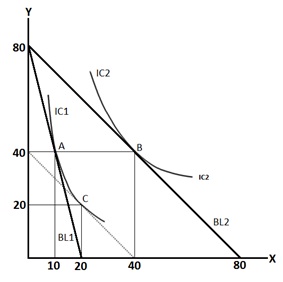

Lea can buy two goods, x and y. Her income is $800. Initially the price of x is $40 and the price of y is $10. Lea's budget line under these prices is BL1 in the diagram below and at these prices Lea consumes bundle A which lies on indifference curve IC1. The price of x then decreases to $10, which shifts Lea's budget constraint to BL2. Lea then consumes bundle B on IC2. Point C represents the bundle she would consume if her income were adjusted to force her to be on IC1 while paying the new prices for x and y.

Question 18. Which of the following summarizes Lea's preferences over A, B and C?

a. A is better than B and B is better than C.

b. A and C are equally good and are both better than B.

c. A and C are equally good and are both worse than B.

d. B is better than C and C is better than A.

Question 19. Lea consumes _____ more units of x due to the substitution effect of the fall in price. Lea consumes ____ more units of x due to the income effect of the increase in real income.

a. 30, 0

b. 20, 10

c. 10, 20

d. 0, 30

Question 20. After the price decrease in good x, how much would Lea's income have to change to return her to her initial level of utility?

a. Lea's income would have to fall by $400 to return her to her initial utility level.

b. Lea's income would have to increase by $400 to return her to her initial utility level.

c. Lea's income would have to fall by $200 to return her to her initial utility level.

d. Lea's income would have to increase by $200 to return her to her initial utility level.

Use the following information to answer the next THREE (3) questions.

Consider the tomato market in the small economy of Econland. In Econland, the market for tomatoes is described by the following equations where P is the price of tomatoes in dollars and Q is the quantity of tomatoes:

Domestic Demand: Q = 1000

Domestic Supply: P = (1/100)Q

Furthermore, suppose you know that the world price of tomatoes is $5.

Question 21. Given the above information and holding everything else constant, if Econland opens to trade in the tomato market, how many tomatoes will they import?

a. 300 tomatoes

b. 500 tomatoes

c. 700 tomatoes

d. 1000 tomatoes

Question 22. If a $2 tariff is then imposed by Econland in the market for tomatoes, how many tomatoes will Econland import?

a. 100 tomatoes

b. 300 tomatoes

c. 500 tomatoes

d. 700 tomatoes

Question 23. Suppose that the domestic demand for tomatoes in Econland increases to Q = 1200. Assume that the world price does not change and that Econland still has a $2 tariff implemented on tomatoes. Given this information and holding everything else constant, Econland’s government revenue from the $2 tariff

a. Increases by exactly $200.

b. Increases by exactly $400.

c. Increases by an amount between $200 and $400.

d. Is indeterminate.

Use the table below to answer the following TWO (2) questions.

Spiculus is beginning his career as a gladiator and is trying to decide whether to work in Rome or in Carthage. Gladiators are paid different amounts in these two cities: the table below contains information about the distribution of salaries in each city (measured in denarii, the Roman currency). Furthermore, prices of goods and services are also different in the two cities, so the table below also contains a price index using Rome as the base location.

| |

Exactly 10% of gladiators in this city earn less than |

Exactly 25% of gladiators in this city earn less than |

The median gladiator in this city earns |

Exactly 75% of gladiators in this city earn less than |

Exactly 90% of gladiators in this city earn less than |

Price index with Rome as the base location |

|

|

| Rome |

50 denarii |

100 denarii |

125 denarii |

175 denarii |

500 denarii |

100 |

|

|

| Carthage |

20 denarii |

30 denarii |

50 denarii |

100 denarii |

150 denarii |

50 |

|

|

Question 24. Using Rome as the base location, the real median salary of a gladiator in Rome is _____ denarii and the real median salary of a gladiator in Carthage is _____ denarii.

a. 125 denarii, 25 denarii

b. 125 denarii, 100 denarii

c. 67.5 denarii, 50 denarii

d. 67.5 denarii, 25 denarii

Question 25. Spiculus knows the gladiators in Rome are very good, so 75% of gladiators in Rome will earn more than Spiculus will if he works there. The gladiators in Carthage are not so good: Spiculus will be able to beat many of them and so will earn a salary higher than 75% of the gladiators in Carthage. Assuming Spiculus only cares about his real salary, Spiculus

a. Should work in Carthage.

b. Should work in Rome.

c. Will be indifferent between working in Rome and working in Carthage.

d. Has insufficient information to answer this question.

Use the following information to answer the next THREE (3) questions.

Assume that the market for ice cream on the Terrace at UW-Madison is perfectly competitive. Each ice cream cart on the Terrace has the same total cost function curve and marginal cost curves. These cost curves are given by the following equations where q is the number of servings of ice cream:

Total Cost Curve for Representative Ice Cream Cart: TC = q4 + 3

Marginal Cost Curve for Representative Ice Cream Cart: MC = 4q3

Question 26. The break-even price of a serving of ice cream is ____ and the shut-down price of a serving of ice cream is ____.

a. $1, $0

b. $1, $3

c. $4, $3

d. $4, $0

Question 27. Suppose now that the market demand for ice cream is given by the following equation where Q is the market quantity of ice cream servings and P is the price per serving:

Market Demand Curve: Q = 100 – 2P

How many servings of ice cream are supplied when this market is in long run equilibrium? Assume that all of the above information is still true and that everything has been held constant.

a. 100 servings of ice cream

b. 94 servings of ice cream

c. 92 servings of ice cream

d. 98 servings of ice cream

Question 28. How many ice cream carts will be present when this market is in long run equilibrium?

a. 25 ice cream carts

b. 23 ice cream carts

c. 92 ice cream carts

d. 94 ice cream carts

The Next Two (2) questions are related to one another.

Question 29. Donald Zurcher is operating a bus company. One day he raises the price of a bus ticket by a small amount and finds that his revenue increases. Then Zurcher

a. Was initially charging a price on the inelastic part of the demand curve.

b. Was initially charging a price on the elastic part of the demand curve.

c. Will definitely make more revenue if he increases the price even more.

d. Will definitely make less revenue if he increases the price even more.

Question 30. Suppose the demand curve for Zurcher's buses is linear. If Zurcher is charging a price that maximizes revenue, the point price elasticity of demand is

a. Strictly greater than one.

b. Equal to one.

c. Strictly smaller than one.

d. Indeterminate.

Question 31. Which of the following statements about cost functions is incorrect?

a. Total cost consists of total fixed cost and total variable cost.

b. The marginal cost curve (MC) intersects the average variable cost curve (AVC) at the lowest point of the average variable cost curve (AVC).

c. The marginal cost curve (MC) intersects the average total cost curve (ATC) at the lowest point of the average total cost curve (ATC).

d. The average fixed cost curve is always upward sloping.

Question 32. Consider the following table that contains data on the nominal and real price of a loaf of bread in ancient Byzantium over time, where the price is in denarii and the base value of the price index is 100.

Inflation between 25 AD and 50 AD was _____ and inflation between 50 AD and 75 AD was ____.

| |

Nominal price of loaf of bread |

Real price of loaf of bread, measured in year 50 AD denarii |

Price index |

| 25 AD |

6 denarii |

10 denarii |

|

| 50 AD |

20 denarii |

20 denarii |

100 |

| 75 AD |

40 denarii |

30 denarii |

133.3333 |

a. 60%, 33.33%

b. 66.67%, 33.33%

c. 60%, 25%

d. 66.67%, 25%

Question 33. Suppose demand and supply for widgets are given by the following equations where P is the price of a widget in dollars and Q is the quantity of widgets:

Demand: Pd = 110 - (1/2)Q

Supply: Ps = (1/2)Q + 10

Suppose the government imposes an excise tax of $20 per widget. Given this information and holding everything else constant, what is the resulting deadweight loss due to the imposition of this excise tax?

a. There is no deadweight loss.

b. $1600

c. $400

d. $200

Question 34. The government is considering imposing an excise tax of $2 per unit on a good. If the suppliers collect the tax for the government, which of the following statements about the economic incidence of this excise tax is true?

a. Consumers do not bear any of the economic burden of the excise tax.

b. Suppliers bear most of the economic burden of the excise tax.

c. The economic burden of the excise tax is split equally between consumers and suppliers.

d. We need more information to know who bears the economic burden of the excise tax.