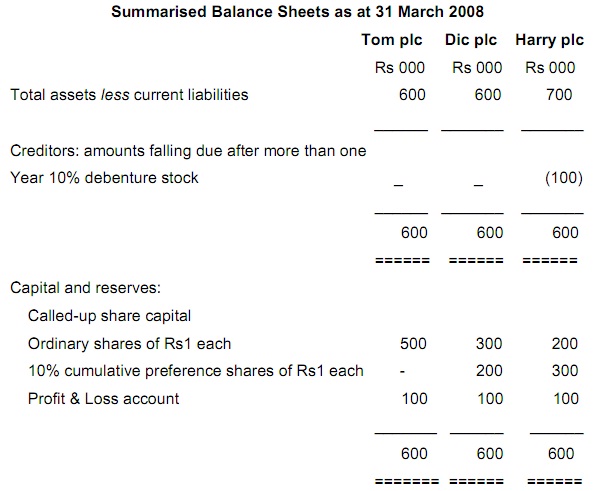

You are presented with the given information for three quite separate and independent companies:

Additional information:

1) The operating profit before interest and tax for the year to 31 March 2008 earned by each of the three companies were Rs 300,000.

2) The efficient rate of corporation for the year to 31 March 2008 is 30%. This rate is to be employed in computing each company’s tax payable on ordinary profit.

3) An ordinary dividend of Rs0.20 for the year to 31 March 2008 is proposed by all the three companies, and any preference dividends are to be given for.

4) The market prices per ordinary share at 31 March 2008 were as shown below:

Rs

Tom plc 8.40

Dic plc 9.50

Harry plc 10.38

5) There were no changes in the share capital structure or in long-term loans of any of the companies throughout the year to 31 March 2008.

Required:

a) Insofar as the information permits, make the profit and loss account for each of the three companies (in columnar format) for the year to 31 March 2008 (formal notes to accounts are not needed).

b) Compute the given accounting ratios for each company:

i) Earnings per share

ii) Price earnings

iii) Gearings (taken as total borrowings (preference share capital and long-term loans) to ordinary shareholders’ funds)

c) By using the gearing ratios computed in answering part (b) of the question, in brief examine the significance of gearing if you were thinking of investing in some ordinary shares in one of the three companies supposing that the profits of the three companies were fluctuating.