Binary Choice:

Question 1. Determine the type of data described below:

"A dataset containing the percentage of tobacco smokers in ten major cities in the U.S. in 2010"

a) Cross-sectional data

b) Time-series data

Question 2. Is the following statement positive or normative?

"The U.S. and the U.K. are among the countries with highest external national debt."

a) Normative

b) Positive

Question 3. The bowed out shape of the PPF is due to ________ opportunity costs of one good in terms of the other good when we produce more of the other good.

a) Rising

b) Falling

Use the following table and information to answer the next THREE questions.

South Africa and Brazil both produce diamonds and coffee beans. Suppose that both countries have the same amount of resources and that both countries have linear production possibility frontiers. Finally assume that both countries use only labor to produce diamonds and coffee beans.

|

|

Number of diamonds per worker

|

Amount of coffee beans per worker

|

|

South Africa

|

15

|

10

|

|

Brazil

|

20

|

20

|

Question 4. Who has the absolute advantage in the production of coffee beans?

a) South Africa

b) Brazil

Question 5. Who has the comparative advantage in the production of coffee beans?

a) South Africa

b) Brazil

Question 6. What is the range of trading prices for 10 diamonds in terms of coffee beans?

a) 10 diamonds will trade between 20/3 coffee beans and 10 coffee beans

b) 10 diamonds will trade between 10 coffee beans and 15 coffee beans

Question 7. Consider the market for rice. Suppose the market is initially in equilibrium and then there is a significant flood in the rice growing regions of the world. Other things being equal, this will:

a) Increase the equilibrium price of rice.

b) Decrease the equilibrium price of rice.

Question 8. Consider the market for coffee beans. Suppose the market is initially in equilibrium and then there is a boom in coffee consumption. Other things being equal, this will:

a) Decrease the equilibrium price of coffee beans.

b) Increase the equilibrium quantity of coffee beans.

Question 9. Suppose the world price of a good is less than the price of that same good in a small closed economy. The effect of opening this small economy to trade in this good will be to:

a) Decrease producer surplus in the market for this good in the small economy.

b) Increase producer surplus in the market for this good in the small economy.

Question 10. The world price of a good is lower than the price of that same good in a small closed economy. Suppose this small country is debating opening its markets to world trade, but also imposing a tariff on imports. Who in this small economy would be against the implementation of the tariff?

a) The home producers of the good will be against the tariff implementation.

b) The home consumers of the good will be against the tariff implementation.

Multiple Choice:

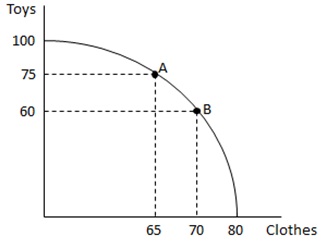

Question 11. The graph above depicts Santa's PPF for toys and clothes. Between the points A and B, what is Santa's opportunity cost of producing 3 additional toys?

a) 4 items of clothing

b) 2 items of clothing

c) 1 item of clothing

d) 0.5 items of clothing

Question 12. The average yearly salary increased by 5% from 2009 to 2010. If the average salary was $21,000 in 2010, what was it in 2009?

a) $22,000

b) $20,500

c) $20,000

d) $19,950

Question 13. X and Y are two goods produced by a country with a PPF given by x2 + y2 = 25. Suppose the country is producing no X. What is the opportunity cost of producing 3 units of X?

a) 1 unit of Y

b) 3 units of Y

c) 5 units of Y

d) 9 units of Y

Question 14. Consider the market for airplane travel, which is initially in equilibrium. How would equilibrium price and quantity change if oil prices drop due to the discovery of new oil deposits, all else held equal?

a) Both price and quantity increase in the market for airplane travel.

b) Both price and quantity decrease in the market for airplane travel.

c) Price decreases and quantity increases in the market for airplane travel.

d) Price increases and quantity decreases in the market for airplane travel.

Question 15. The following are the domestic demand and domestic supply equations for shirts in a small open economy

Domestic Demand: P = 100 - Q

Domestic Supply: P = Q

This economy has imposed a tariff on imported shirts that results in 6 shirts being imported into this economy. You are also told that the world price of a shirt in $42. What is the tariff revenue this country earns from the shirt market?

a) $0

b) $10

c) $18

d) $30

Question 16. Where do the lines y = 5x and y = x/5 intersect?

a) These two equations don't intersect.

b) At the point (1, 1)

c) At the point (0, 0)

d) At the point (-1, 1)

Use the following table to answer the next THREE questions:

|

|

Hours to produce a minute of a guitar piece

|

Hours to produce a minute of a vocal piece

|

|

Keith Moon

|

15

|

10

|

|

Axl Rose

|

10

|

5

|

|

Jimmy Page

|

5

|

10

|

All musicians have 150 hours each to produce guitar and vocal pieces.

Question 17. How many minutes of each piece (vocal piece, guitar piece) can Jimmy produce if he produces equal amounts of each piece on his own?

a) 15 minutes of vocal piece, 15 minutes of guitar piece

b) 5 minutes of vocal piece, 5 minutes of guitar piece

c) 10 minutes of vocal piece, 10 minutes of guitar piece

d) 8 minutes of vocal piece, 8 minutes of guitar piece

Question 18. Who has the comparative advantage in the production of guitar pieces?

a) Axl

b) Keith

c) Jimmy

d) There isn't enough information to determine who has comparative advantage.

Question 19. On their combined PPF, how many minutes of guitar pieces are the three of them producing, if they are producing 45 minutes of vocal pieces?

a) 15 minutes of guitar piece

b) 30 minutes of guitar piece

c) 40 minutes of guitar piece

d) 55 minutes of guitar piece

Question 20. Last year there were 1100 students pursuing an Economics major at UW and this year the number of majors increased to 1250. What is the percentage change in Economics majors at UW from last year to this year?

a) 12.1%

b) 13.6%

c) 15%

d) 16.9%

Question 21. Consider the market for corn. Suppose the market is initially in equilibrium and then a significant drought hits the corn-growing regions of the world. In addition, the development of bioethanol as an alternative fuel increases the demand for corn. As a result,

a) We can expect both price and quantity to decrease in the corn market.

b) We can expect quantity to decrease, but cannot predict the change in price in the corn market.

c) We can expect price to increase, but cannot predict the change in quantity in the corn market.

d) We can expect price to decrease, but cannot predict the change in quantity in the corn market.

Use the following information to answer the next THREE questions.

Imagine a small economy that produces one good. It is known that the domestic supply curve goes through the points (Q,P) = (20,40) and (46,66), and the domestic demand curve goes through (Q, P) = (28,66) and (10,75).

Question 22. If this economy is not open, what is the equilibrium price?

a) P = $40

b) P = $50

c) P = $60

d) P = $70

Question 23. Suppose the world price is $50 for the good described in the last question. Suppose the small economy opens this market to trade. What is the value of consumer surplus in the small economy given these changes?

a) $900

b) $400

c) $800

d) $1800

Question 24. Suppose this small economy is open to trade and a quota of 6 units is imposed. What is the deadweight loss due to the quota?

a) $152

b) $125

c) $48

d) $96

Question 25. Maria's PPF is linear and contains the two points (30,10) and (25,15). Given this information, which of the following points is feasible, but inefficient, for Maria?

a) (5,35)

b) (10,32)

c) (20,22)

d) (35,4)

Question 26. When is a producer producing efficiently?

a) When he cannot produce more of one good without giving up some of the other good.

b) When he can sell his product at the highest price possible.

c) When he is making the highest possible profit.

d) When he is producing below his production possibilities frontier.

Use the following information to answer the next TWO questions.

Suppose that the market demand for pens is given by P = 50 - Q and the market supply of pens is P = 10 + Q.

Question 27. Given this information, what is the equilibrium quantity of pens?

a) Q = 25 pens

b) Q = 20 pens

c) Q = 30 pens

d) Q = 28.5 pens

Question 28. Suppose that due to a technological advance, supply increases by 10 pens at any given price. Holding everything else constant, what is the new equilibrium quantity in the market for pens?

a) Q = 25 pens

b) Q = 23 pens

c) Q = 27 pens

d) Q = 30 pens

Use the following information to answer the next TWO questions:

|

|

Workers needed to produce 1 gallon of milk

|

Workers needed to produce 1 pound of timber

|

|

Denmark

|

4

|

3

|

|

Argentina

|

12

|

16

|

Suppose timber is on X axis and milk on the Y axis. Denmark has 60 workers and Argentina has 240 workers.

Question 29. Given the above information it is possible to graph the joint PPF for these two countries. Which pair of coordinates (timber, milk) below represents the kink on this joint PPF?

a) (15,20)

b) (20,15)

c) (15,15)

d) (20,20)

Question 30. Suppose Denmark becomes twice as efficient in both milk and timber production (that is, it can produce both goods with half of the workers that it needed before). What is the new range of trading prices for 1 gallon of milk in terms of pounds of timber if the two countries decide to trade?

a) The acceptable range of trading prices will be between 3/4 pound of timber and 4/3 pounds of timber.

b) The acceptable range of trading prices will be between 3/8 pound of timber and 4/3 pounds of timber.

c) The acceptable range of trading prices will be between 3/4 pound of timber and ½ pound of timber.

d) The acceptable range of trading prices will be between 3/4 pound of timber and 2 pounds of timber.