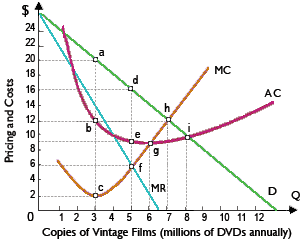

At the point upon the demand curve for Silver Screen Classic DVDs, here the price elasticity of demand is unitary, the price would be approximately: (i) $10, resulting in roughly 8 million DVDs being sold. (ii) $13, resulting in approximately 6.5 million DVDs being sold. (iii) $16, resulting in about 5 million DVDs being sold. (iv) $20, resulting in around 3 million DVDs being sold. (v) $23.50, resulting in approximately 1million DVDs being sold.

How can I solve my Economics problem? Please suggest me the correct answer.