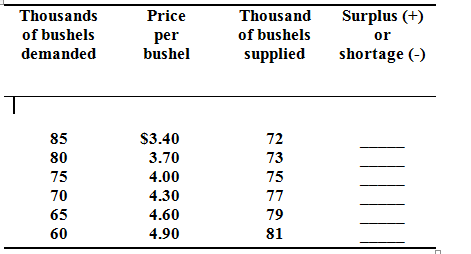

Assume that the government establishes a price ceiling of $3.70 for wheat. What may prompt the government to establish this price ceiling? Describe carefully the main influence. Show your answer graphically. Next, explain that the government establishes a price floor of $4.60 for wheat. What will be the major effects of this price floor? Show your answer graphically.