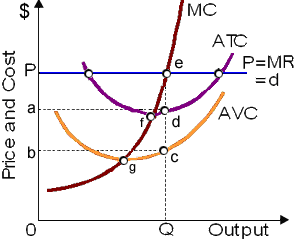

For such illustrated figure profit-maximizing pure competitor, there area aPed shows: (1) fixed cost (TFC). (2) average fixed cost (AFC). (3) the lowest possible economic loss. (4) maximum economic profits. (5) the rate of return on investment.

Please choose the right answer from above...I want your suggestion for the same.