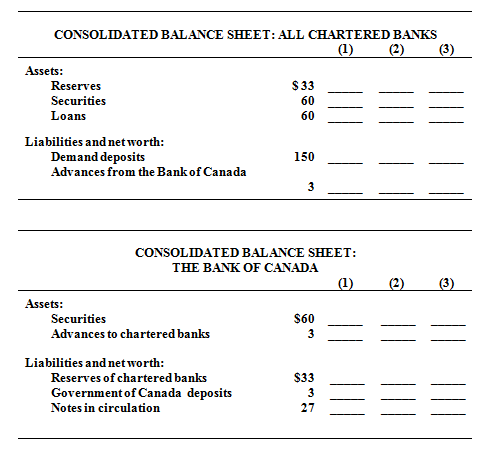

In the below table you will determine consolidated balance sheets for the chartered banking system & the Bank of Canada. Employ columns 1 through 3 to show how the balance sheets would read after each of transactions a to c is finished. Analyze separately each transaction, beginning in each of case from the figures provided. All of the accounts are in billions of dollars.

a. A decline into the discount rate prompts chartered banks to borrow an added $1 billion from the Bank of Canada. Illustrate the new balance-sheet figures in column 1 of each table.

b. Bank of Canada sells $3 billion into the securities to members of the public, who pay for the bonds with cheques. Illustrates the new balance-sheet figures in column 2 of each table.

c. The Bank of Canada purchase $2 billion of securities through chartered banks. Illustrated the new balance sheet figures in column 3 of each of the table.

d. Now review each of the above three transactions, asking yourself these three questions: (1) What modification, if any, took place in the money supply as a direct and instant result of each transaction? (2) What increase or decrease in chartered banks' reserves occurs in each of transaction? (3) Supposing a desired reserve ratio of 20 percent, what change in the money making potential of the commercial banking system occurred consequently of each transaction?