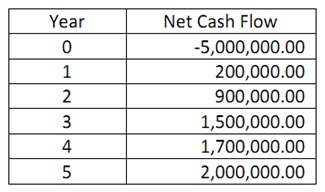

UCD Vet Products – a hypothetical publicly traded corporation (UCDV) — is considering investing in a new line of equine DNA analysis technology for race horse breeders. The project will yield the net cash flows listed in the table below. Assume that this project is as risky as UCDV’s stock and suppose that the risk free rate is 1% per year, the expected market return is 8%, and UCDV’s beta is 0.55.

What is the net present value of expansion project? Should UCDV undertake the project? How would your answer change if UCDV’s beta were 1.5 rather?