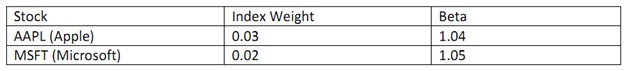

Suppose that the two securities APPL and MSFT account for the entire large cap technology component of the S&P 500 (hypothetically – of course – there are really plenty of others). Further, suppose that their weights in the S&P index were as follows:

So that, for example, AAPL makes up 3% of the index since its weight is 0.03. [These weights are hypothetical – actual weights are computed based on the current market capitalization of each company included in the index, so they change all the time]

a. What fraction of the total portfolio is this large cap technology sector?

b. What is the beta of this large cap technology sector?

c. If the S&P 500 is the market portfolio, what is its beta?

d. What is the beta of the remaining stocks in the S&P (consider these as a single sector)?