Question 1: At the beginning of 20X2, Dahl Ltd. acquired 8% of the outstanding common shares of Tippy Ltd. for $400,000. This amounted to 80,000 shares.

At the beginning of 20X4, Dahl acquired an additional 270,000 shares of Tippy for $1,512,000. At this acquisition date, Tippy's shareholders' equity consisted of the following:

4% non-cumulative preferred shares $1,000,000

Common shares, 1,000,000 outstanding shares 2,400,000

Retained earnings 2,160,000

At this acquisition date, the fair values of the net identifiable assets equalled their carrying values except for the following:

Excess of fair value over carrying value

Inventory $ 96,000

Land 800,000

At the beginning of 20X5, Dahl acquired an additional 450,000 shares of Tippy for 2,880,000. The shares were trading for $6 per share. At this acquisition date, Tippy's shareholders' equity consisted of the following:

4% non-cumulative preferred shares $1,000,000

Common shares, 1,000,000 outstanding shares 2,400,000

Retained earnings 2,560,000

At this acquisition date, the fair values of the net identifiable assets equalled their carrying values except for the following:

Excess of fair value over/ (under) carrying value

Accounts receivable $W (48,000)

Building and equipment (net) 720,000

Long-term debt 160,000

The building and equipment have an estimated remaining life of 10 years and the long-term debt matures in 10 years.

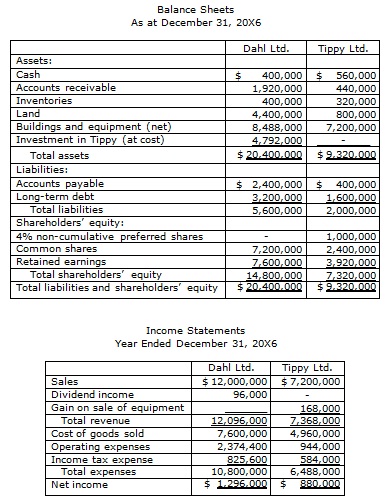

The condensed separate-entity financial statements for December 31, 20X6 are as follows:

Additional information:

A) Dahl and Tippy declared and paid dividends throughout 20X6 of $400,000 and $160,000, respectively.

B) At the end of 20X5, the inventories of Dahl and Tippy included goods with intercompany profits of $68,000 and $152,000 correspondingly.

C) During 20X6, Dahl sold goods to Tippy for $3,120,000 at a gross margin of 45%. At the end of 20X6, $200,000 of such goods was still in Tippy's inventory.

D) During 20X6, Tippy sold goods to Dahl for $2,080,000 at a gross margin of 35%. At the end of the year, $320,000 of such goods was still in Dahl's inventory.

E) On January 1, 20X6, Tippy sold certain equipment to Dahl for $360,000. At that time, the equipment had a book value of $192,000 and an estimated remaining life of 8 years. Dahl has paid Tippy $252,000 and will pay the balance on January 31, 20X7.

F) Both Dahl and Tippy employ the straight-line method of amortization for their buildings and equipment.

G) In 20X5, a goodwill impairment of $73,600 was recognized and a further impairment of $46,400 occurred in 20X6. Impairment losses are assigned to 80% to Dahl and 20% to the non-controlling interest.

H) Both companies are taxed at an average rate of 40%.

Required:

Compute Dahl's 20X6 consolidated net income and recognize the amount attributable to Dahl's shareholders and to the non-controlling interest. Be sure to show all your computations. You are not needed to prepare a consolidated income statement.

Question 2:

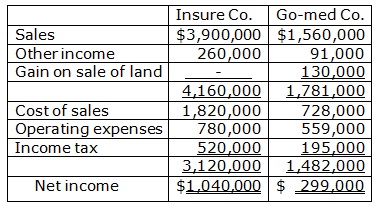

Income Statements

Year Ended December 31, 20X8

Insure acquired 40% of the common shares of Go-med in 20X2 for $1,072,500.

For 20X8, Insure amortized its acquisition differential as follows:

Buildings $ 11,700

Long-term liabilities (16,250)

Goodwill impairment loss 16,900

$ 12,350

During 20X8, Go-med paid royalties of $162,500 to Insure, which Insure comprised in its other income.

During 20X8, Go-med sold land to a third party. It had acquired the land 3 years ago from Insure. At that time, Insure had recorded a profit on the sale of $29,250.

During 20X8, Go-med declared and paid dividends of $104,000.

Both Insure and Go-med pay taxes at an average rate of 40%.

Required:

Suppose that Go-med is a joint venture owned by Insure and four other ventures, that the acquisition differentials are valid and that it has not yet adopted IFRS 11: Joint Arrangements. Make a 20X8 consolidated income statement for Insure employing proportionate consolidation.

Question 3: On April 1 of the current year, Econ Ltd. ordered maps from a foreign supplier for 500,000 units of foreign currency (FC). On April 2, Econ entered a forward contract as a cash flow hedge to acquire 500,000 FC on July 31 for $0.31. On July 31, the maps arrived and Econ paid the supplier in full and settled the forward contract. Econ has an April 30 year-end.

Spot Rate Forward Rate

April 1 and 2 FC 1 = $0.280 FC 1 = $0.310

April 30 FC 1 = $0.270 FC 1 = $0.305

July 31 FC 1 = $0.320 FC 1 = $0.320

Required:

a) Prepare dated journal entries to record the transactions shown above.

b) Suppose that Econ did not enter into a forward contract. Prepare dated journal entries to record the transactions above.

c) Suppose that Econ had entered into a forward contract that was designated a fair value hedge. Prepare dated journal entries to record the transactions above.

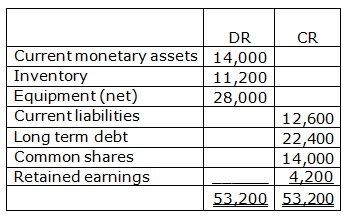

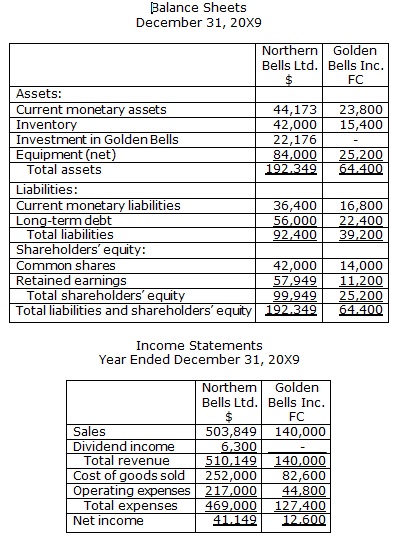

Question 4: Golden Bells Inc. is a foreign subsidiary of Northern Bells Ltd., a Canadian company. Northern Bells had purchased 90% of the outstanding shares of Golden Bells at the starting of 20X9 for 20,160 foreign currency (FC) units. At acquisition date, Golden Bells' balance sheet in FC units is as shown below:

At the acquisition date, the only acquisition differential was in regard to the equipment, which had a fair value of 30,800 FC and an estimated remaining useful life of 10 years.

The relevant exchange rates for 20X9 are as follows:

January 1 FC 1 = $1.10

September 15 FC 1 = $1.20

December 31 FC 1 = $1.25

Average rate for 20X9 FC 1 = $1.18

At the end of 20X9, Northern Bells and Golden Bells declared dividends of $30,800 and 5,600 FC, correspondingly.

Golden Bells' goods in inventory at the end of 20X9 were from a special purchase made September 15, 20X9.

Golden Bells had a goodwill impairment loss of 140 FC that occurred evenly throughout 20X9.

Northern Bell uses the entity theory method to consolidate its subsidiary.

Required:

Make Northern Bell's consolidated financial statements for December 31, 20X9, supposing that Golden Bell's functional currency is:

i) The Canadian dollar, and

ii) The foreign currency unit.

Question 5: Wise Owls, an NFPO, began operations at the beginning of 20X1 to provide free tutoring and homework assistance, and also a nutrition program, to low-income immigrant children. The local school board has provided Wise Owls with the use of a wing of a school at a heavily discounted rate of $1,000 per month. During 20X1, Wise Owls rented the wing for the full year and plans to continue to do so until it can construct its own building. Wise Owls is funded primarily by donations.

This year's fundraiser was very successful and exceeded expectations. Additionally to the net proceeds of $350,000 from the fundraising event, another $50,000 was pledged by attendees, but most of these pledges have not yet been collected. They will probably be collected early next year. Of the $50,000 pledged, $10,000 was pledged for the purchase of land, and Wise Owls received it a few days after its year-end. Of the $350,000 raised, $40,000 was designated for the purchase of a tract of land on which the organization plans to erect a building for its programs. Wise Owls still needs to raise another $10,000 before the land can be purchased. If everything goes according to plan, it will be able to purchase the land for $60,000 within the first six months of 20X2.

Wise Owls is especially happy with its fundraiser because the government has committed to provide matching funds, to a maximum of $250,000, of the net proceeds raised for operations. It received a letter from the government two weeks after year-end advising it that its application had been approved and that it can expect the grant in six weeks.

Wise Owls has had good support from the local community. Four grocery stores in the area provided donations totaling $25,000 of food for Wise Owls' nutrition program. An office supply store provided $2,500 of school supplies and a card for $5,000 of photocopying services.

All of the people working at Wise Owls are volunteers except for the full-time director and the part-time volunteer coordinator. During 20X1, the director was paid $70,000 and the coordinator was paid $26,000. $2,000 of the amount paid to the coordinator was an advance against her salary in January, 20X2. Normally, advances are not allowed; however, due to extenuating circumstances, the board allowed it.

During 20X1, Wise Owls spent $53,000 on food, $10,000 on school supplies, and $90,000 on other operating expenses.

Wise Owls will buy 40 laptop computers in the next year for use in several of its programs. The director has negotiated a deal with a supplier to get the computers for $20,000. The computers should be delivered in a month, with payment due on delivery.

Required:

By using the deferral method, make a statement of revenues and expenses and a statement of changes in net assets for Wise Owls for 20X1.