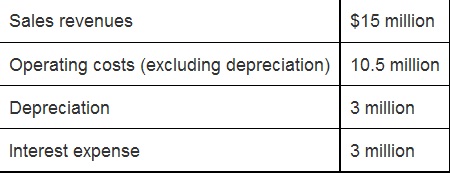

Problem: Eisenhower Communications is starving to estimate the first-year net operating cash flow (at Year 1) for a proposed project. The financial staffs have gathered the following information on the project:

The company has a 40% tax rate, and its WACC is 11%.

Write out your answers. For instance, 13 million should be entered as 13,000,000.

Question1. What is the project's operating cash flow for first year (t = 1)?

Question2. When this project would cannibalize other projects through $1.5 million of cash flow before taxes per year, how would this change your answer to part a?

The firm's OCF would now be $

Question3. When the tax rate dropped to 30%, how would that change your answer to part a?

Question4. The firm's operating cash flow would -Select-increase decrease (decrease or increase) Item 3by $