Case Scenario:

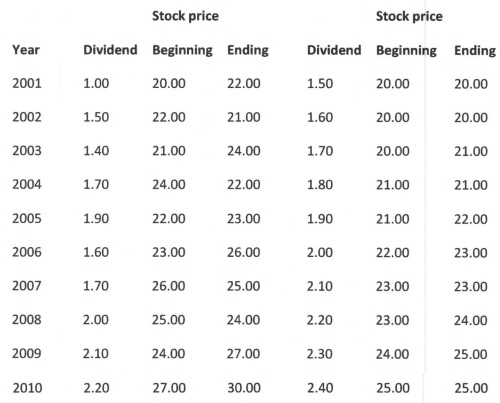

Junior Sayou, a financial analyst for Chargers Investments, a mutual fund management company, must evaluate the risk and return of two stocks, X and Y. The firm is considering adding these stocks to its diversified stock portfolio. To assess the return and risk of each stock, Junior gathered data on the annual dividends and beginning- and end-of-year prices of each stock over the immediately preceding 10 years, 2001-2010. These data are summarized in the accompanying table. Junior's investigation suggests that both stocks, on average, will tend to perform in the future just as they have during the past 10 years. He therefore believes that the expected annual return can be estimated by finding the average annual return for each stock over the past 10 years. Junior believes that each stock's risk can be assessed in two ways: in isolation and as part of the firm's diversified portfolio of stocks. The risk of the stocks in isolation can be found by using the standard deviation and coefficient of variation of returns over the past 10 years. The capital assets pricing model (CAPM) can be used to assess the stock's risk as part of the firm's portfolio of stocks. Applying some sophisticated quantitative techniques, Junior estimated betas for stocks X and Y of 1.60 and 1.10, respectively. In addition, he found that the risk-free rate is currently 7% and that the market return is 10%. Note: you may find it easier and time effective to solve the problems using Excel or any other spreadsheet software.

Question 1: Calculate the annual rate of return for each stock in each of the 10 preceding years, and use those values to find the average annual return for each stock over the 10-year period.

Question 2: Use the returns calculated in part (1) to find (i) the standard deviation and (ii) the coefficient of variation of the returns for each stock over the 10-year period 2001-2010.

Question 3: Use your findings in parts (1) and (2) to evaluate and discuss the return and risk associated with each stock. Which stock appears to be preferable? Explain.

Question 4: Use the CAPM to find the required return for each stock. Compare this value with the average annual returns calculated in part (1).

Question 5: Compare and contrast your findings in parts (c) and (d). What recommendations would you give Junior with regard to investing in either of the two stocks? Explain to Junior why he is better off using beta rather than the standard deviation and coefficient of variation to assess the risk of each stock.