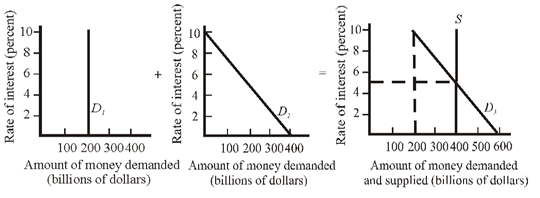

Help me to go through this problem. Refer to the given market for money diagrams. If the interest rate was at 8 percent, people would: A) sell bonds, which would cause bond prices to fall and the interest rate to fall. B) buy bonds, which would cause bond prices to rise and the interest rate to fall. C) have insufficient liquidity, which would cause them to reduce their spending on consumer goods. D) buy bonds, which would cause bond prices to fall and the interest rate to rise.