A software company has a new product specifically designed for the lumber industry. The VP of marketing has been given a budget of $1,35,00to market the product over the quarter. She has decided that $35,000 of the budget will be spent promoting the product at the national trade show in New Orleans which will be held during this planning quarter.

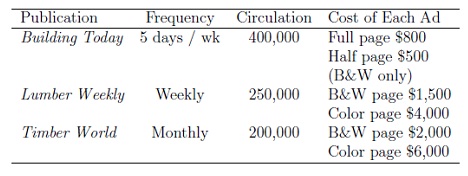

Because eh product targets a specialized audience the VP has ruled out television radio and mainstream magazine advertisements. Instead she has decided to promote the product using black and white (B &W) and color ads in some or all of the followings specialized publications: Building today lumber weekly and timber world building today is a week day trade newspaper that accepts both full page and half page black and white advertising. Lumber weekly and timber world are glossy magazines that run both black and white and color ads. The VP and her staff have decided to run only full page ads in these last two publications. The circulation and advertising cost data for each outlet is summarized in the following table:

After a discussion of the potential advertising the marketing team made the following judgment:

• A maximum of one ad should b placed in any one issue of any of the trade publications during the quarter:

• At least 50 full page ads should appear during the quarter:

• At least eight color ads should appear during the quarter:

• One ad should appear in each issue of timber world:

• At least four weeks of advertising should be placed in each of the building today and lumber weekly publications:

• No more than $40,000 should be spent on advertising in any one of the trade publications.

Formulate a linear programming model that will provide the VP and her marketing staff a marketing plan for the next quarter to maximize audience exposure for their new software product.

Implement your formulation in excel and find the optimal solution using solver. Sum marize your solution (decision variable values and objective function value ) below your formulation.