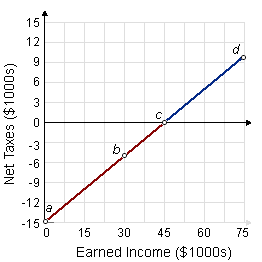

Under the negative income tax system demonstrated in this figure, a family of four along with earned income of $15,000 yearly would have a net [after-tax] income of: (i) $30,000 per year. (ii) $27,500 per year. (iii) $25,000 per year. (iv) $22,500 per year. (v) $20,000 per year.

Can someone explain/help me with best solution about problem of Economics...