Assignment

Mina Patel has seen attractive advertisements for Dixons Retail plc and its UK-based brands. She is also aware of the intense competition between retailers of electronic and electrical goods, at a time of global economic uncertainty. Mina has recently inherited several thousand pounds and has started building a portfolio of investments, and she seeks your advice on whether or not to buy shares in the company.

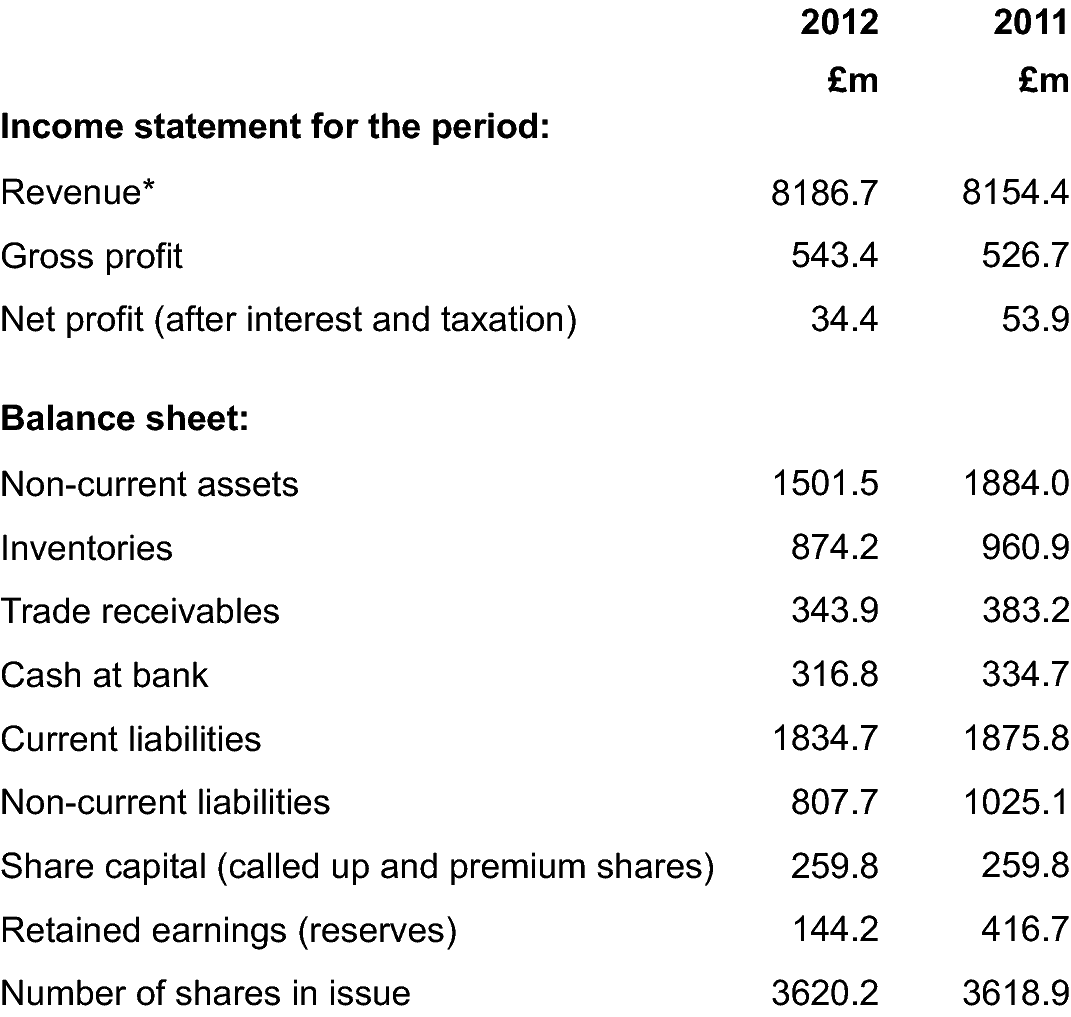

She has provided you with the following summarised information taken from the Annual Report and Accounts 2011/12 of Dixons Retail plc, for the 52 weeks ended 28 April 2012 and 30 April 2011.

* Assume that all sales and purchases are made on credit rather than by cash payment.

Note that figures are extracted from the consolidated financial statements of the Group.

The share price of Dixons Retail plc in April 2012 is £0.18 per share (£0.11 pence in 2011) and it has been around this level for the past few months (note: the current value of shares might be different at the time of completing this assignment). The retail association to which Dixons Retail plc belongs compiles ratios taken from the annual accounts of its members, and from other sources, and you have obtained the following recent industry averages for some key ratios:

- gross profit margin - 15%

- current ratio - 2.05 times

- acid test ratio - 1.10:1

- average settlement period for trade receivables - 20 days

- average inventories turnover period - 30 days

- gearing ratio - 55%

- price/earnings ratio - 10 times

(a) Calculate the above ratios 1-7 for Dixons Retail plc for the 2012 and 2011 periods. Show how you have arrived at your answers, so your tutor can provide specific feedback if errors have been made. (15 marks)

(b) Comment on how the company's overall performance compares to the average for its industry, pointing out any significant features, assumptions and limitations of the information used to analyse the company's performance. (30 marks)

(c) On the basis of the data available, what advice would you give to Mina Patel about investing in shares in Dixons Retail plc? In compiling your advice, comment on the differential risks and returns investors may expect from investing in shares as opposed to bank deposit accounts. What further information, in addition to the financial information in question (a), would you advise Mina Patel to seek before she makes her decision about investing in the shares of Dixons Retail plc? (30 marks)

Guideline length: 1500 words.

For (a) it is essential to treat ratio analysis with caution and to understand the basis of calculations and the nature of the data used. In this assignment sufficient information has been made available to you to compare and interpret the ratios of Dixons Retail plc and industry averages. Marks will be awarded for the correct calculation of each of the seven ratios, and provided you show how you have arrived at your answers your tutor will be able to reward correct calculations and explain what you should have done if parts of the answers are incorrect.

For (b) the key approach is to ask yourself 'What value do we expect for each ratio? What might any apparent trends over time signify? What is relatively "good" or "poor" performance for each ratio?' You should explain any assumptions that you have made and give your interpretation of the similarities and differences between Dixons and the industry average.

You will see from the learning outcomes that what is required is application of module concepts, a clear account of your analysis and relevant conclusions. Your own interpretation of the relative performance of Dixons might be influenced by your wider knowledge of the company or industry sector, but your tutor will not be expecting students to have 'inside knowledge' in order to give an excellent answer here.

For (c) you should think about how factors affecting the value of publicly owned companies are included in the kinds of financial statements you met in Session 41. Ask yourself 'What additional information would be useful for interpreting the company's performance?' In thinking about the likely future performance of the company you could draw on the bigger picture, such as news about competitors or your impressions about the company's management gained from the case study materials

Many people today invest in a personal share portfolio, and in answering this question it is important to consider the sorts of information relevant to an individual like Mina Patel. Other shareholders such as pension schemes and managers of short-term investment funds will probably consider different factors. Again, it is important to specify any assumptions you make, for example about Mina's priorities, or economic or technological environmental factors affecting company performance. (You should note that that in reality one might not make a share purchase decision in February based on information about the year to the previous April.)