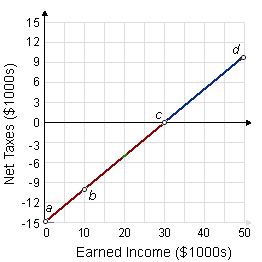

Under the negative income tax system demonstrated in this figure, where a family of four all along with earned income of $60,000 yearly would have a net [after-tax] income of: (1) $37,500 per year. (2) $42,500 per year. (3) $50,000 per year. (4) $55,000 per year. (5) $60,000 per year.

How can I solve my Economics problem? Please suggest me the correct answer.