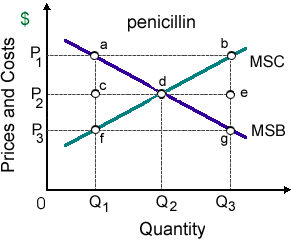

The socially optimal production of penicillin arises while quantity: (a) Q1 is produced and sold at price P1. (b) Q1 is produced and sold at price P3. (c) Q2 is produced and sold at price P2. (d) Q3 is produced and sold at price P1. (e) Q3 is produced and sold at price P3.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?