Question 1:

The financial crisis that hit the United States first and then the world economy starting in fall 2007 meant that the future prospects of many firms looked gloomy at best for some time. Comment on the effect of a recession on the investment curve (only) and on the level of savings, investment, and the equilibrium real interest rate. Show your answer using a graph.

Answer

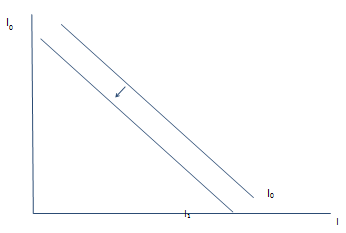

As the future prospect for economies worldwide did not look good, there was a dip in the business confidence. What this means is that businesses were not looking to make more investment, given the pessimist view of the demand in future. Therefore, at existing level of interest rate, there will be lesser demand for investment. This is shown by a downward shift of the investment demand curve from I0 to I1 in the graph below.

On the consumers' side, a dim future prospect for the economy would lead to less consumption today and more savings. This is because of the fact people do not expect to earn more in the future due to slowdown in the economy. Therefore, in order to compensate for the expected fall in earning tomorrow, consumers save more today.

If we combine these two facts, then we see that both, the aggregate demand and the investments demand, in the economy will fall. This will mean that the demand for money will fall down as the transaction demand for money decreases. Given the fixed money supply, it will imply that there is excess supply of money in the market and hence there will be afall in the interest rate.