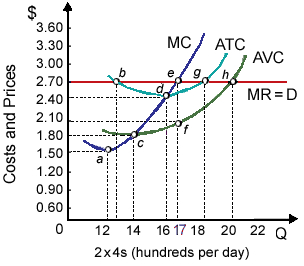

When generic lumber processing is a constant cost industry, within the long run this lumber mill is probable to experience a: (i) a severe shrinking of economic profit to zero. (ii) a decline within the price of 2×4s to about $2.40 apiece. (iii) an increase into competitors as new lumber mills begin operating. (iv) reduction into the lumber mill’s equilibrium output. (v) All of the above.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?