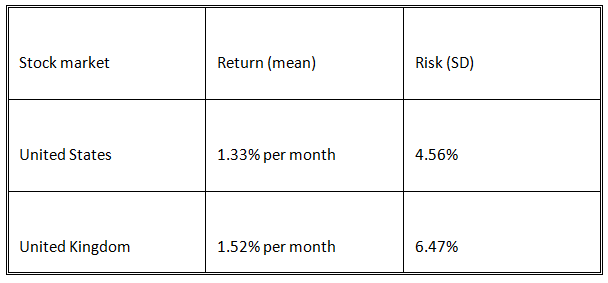

We attain the following data in dollar terms:

The correlation coefficient among the two markets is 0.57. Assume that you invest equally, that means 50% each, in the two markets. Find out the expected return and standard deviation risk of the resulting international portfolio.

The expected return of the similarly weighted portfolio is following:

E(Rp) = (.5)(1.33%) + (.5)(1.52%) = 1.43%

The variance of the portfolio is following:

Var(Rp) = (.5)2(4.56)2 + (.5)2(6.47)2 +2(.5)2(4.56)(6.47)(.57)

= 5.20 +10.47 + 8.41 = 24.08

Thus the standard deviation of the portfolio is 4.91%.