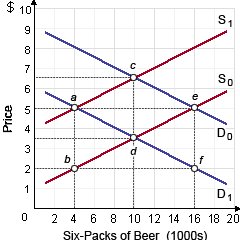

The new supply and demand curves within University City were S0 and D0, before the county commission imposed a $3 per six-pack excise tax upon beer. The new equilibrium quantities of six-packs sold per month and equilibrium prices, respectively, were: (w) 4,000 six-packs at $5 each. (x) 10,000 six-packs at $3.50 each. (y) 10,000 six-packs at $7 each. (z) 16,000 six-packs at $5 each.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?