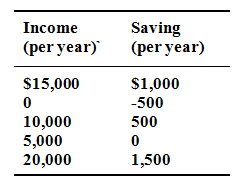

The given table contains data on the relationship among saving and income. Rearrange these data in a meaningful order and graph them onto the accompanying grid. Depict the slope of the line? And vertical intercept? Interpret the meaning of the slope and the intercept both. Write down the equation that represents this line. What would you calculate saving to be at the $12,500 level of income?