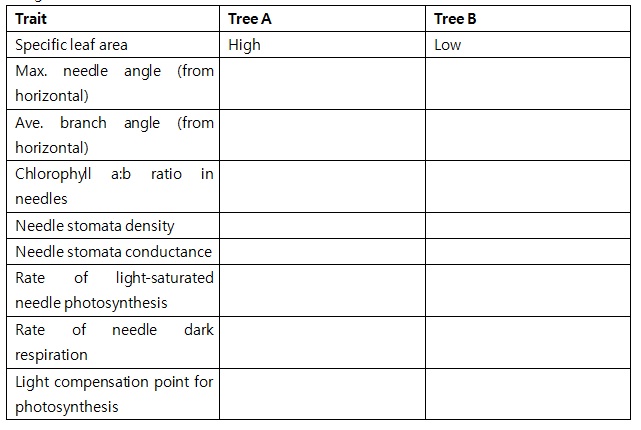

Recently, a friend accused her neighbor of harvesting a tree (sapling of balsam fir, Abies balsamea) from her land without permission. Her neighbor claims that he bought it from a Christmas tree plantation (growing in a clearing down the road). Your friend says the tree was harvested from the understory of her mixed conifer-hardwood forest (although she can’t locate the cut stump). In order to help determine the guilt or innocence of the accused, you compare the physiological and morphological traits of his tree with those of an open-grown tree from the plantation down the road. Based solely on the leaf morphology data in the table, which tree (A or B) most likely grew in your friend’s understory? (Assume that the soil was similar in both places.) Based on your answer and information you find in the literature, provide a qualitative guess regarding differences between Tree A and Tree B in the remaining traits. Specifically, for each tree, insert “high” or “low” for each trait.