Case Scenario:

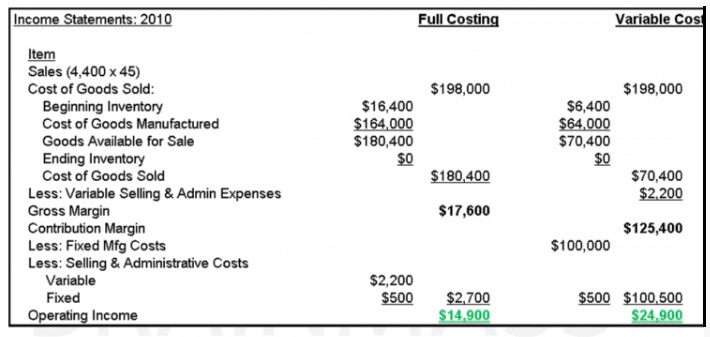

Stacy Lynn, Inc. (SLI) is a manufacturer of rice cookers. The rice cookers sell for $45 per unit; the sales were 3,600 units in the current year, 2009. SLI has 400 units available for sale at the end of 2009 and is projecting sales of 4,400 units in 2010. SLI is planning the same production level for 2010 as in 2009, 4,000 units. The variable manufacturing costs for SLI are $16 and the variable selling costs are only $.50 per unit. The fixed manufacturing costs are $100,000 per year and the fixed selling costs are only $500 per year. Assume that beginning inventory was -0- for 2009.

Stacy Ann Lynn, the great grand-daughter of the company's founder is the current CEO/President of the company, which is still a family owned business. The previous several years have been especially difficult due to price-pressure from Chinese imports. At the moment, all that Stacy believes she can do is to try to keep the company running until the economy improves. But, the company needs an immediate infusion of cash. So, she has decided to ask her bank for a large line of credit to maintain operating viability for the foreseeable future.

Additional Financial Information for SLI, 2009 and 2010:

1) If Patty wants to show the bank the maximum profit over the previous 2-year period, which costing method should she present?

2) But, the bank requires that all financial statements conform to Generally Accepted Accounting Principles (GAAP). Based on that requirement, which costing method should she present?

3) The bank has delivered a memo in preparation for the meeting to negotiate the Credit Line; the memo states that they will expect a significant Net Income. Based on your responses to parts A and B, what are the legal and ethical issues facing Stacy Lynn?