Problem set. International Money and Finance

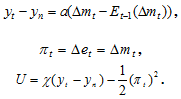

1. Consider the following model:

Notation: t denotes time, y denotes output, yn is the potential output, e is the nominal exchange rate, U is the government's utility function, Δmt is money growth, E expectations operator. Πt is the inflation at time t.

a) Explain how inflation and output are determined in the model, in particular, discuss government preferences about output and inflation. Also explain the determination of the nominal exchange rate in this model.

b) Show that the ex-ante optimal policy implies that government will announce zero inflation and a constant exchange rate.

c) Compute the ex-post optimal monetary policy and the consequences for nominal exchange rate. Explain your results

d) Compute the optimal monetary policy, when the government decides to delegate the monetary policy in a conservative central bank with thefollowing objective function U = -1/2(Πt)2. Show that a fixed exchange rate could be used to solve the time- inconsistency problem. Explain your results.