Financial Statements

Kaska Ltd. is a Canadian mining corporation operating in Northern Alberta, with the head office located in Calgary, Alberta. Kaska also has a branch office in Ontario and British Columbia. You have recently been hired as the Corporate Controller. Kaska Ltd. is a publicly traded Canadian corporation and follows IFRS. Kaska Ltd. has never had an audit performed, and has decided to engage an external auditor this year, due in part to some apparent irregularities in the financial reports of recent years.

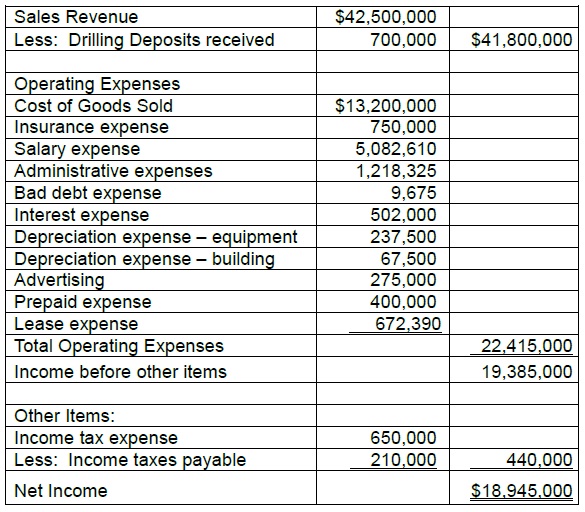

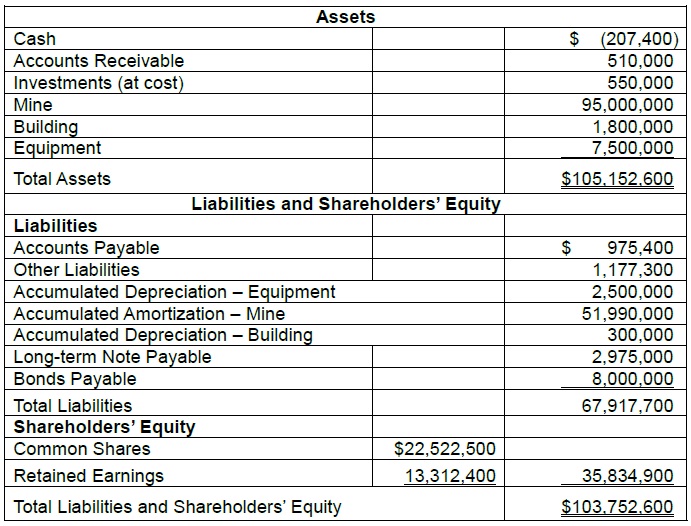

You have been presented with the following draft financial statements for the year ended December 31, 2011, as prepared by the junior accountant, who left the company abruptly. The first thing you have noticed is that the Statement of Financial Position does not balance.

In addition to the statements, you have compiled additional information that you managed to pull together from notes and files found on the junior accountant’s desk.

Kaska Ltd.

Draft Statement of Retained Earnings

For the year ended December 31, 2011

Retained Earnings beginning of year $ 9,641,300

Add: Net Income 18,945,000

28,586,300

Less: Dividends declared and paid $ 273,900

Future Restoration costs 15,000,000 15,273,900

Retained Earnings end of year $ 13,312,400

Notes and additional information:

1. Kaska Ltd. has always had an effective income tax rate of 30%, and this rate is expected to remain in effect. The effective borrowing rate for any incremental borrowing is 3.0%, unless specifically stated otherwise.

2. Interest expense, for the bonds and note payable was calculated as follows: ($8,000,000 x 5%) + ($3,400,000 x 3%).

3. The bonds were issued on January 1, 2011, have a stated interest rate of 5.0% payable on June 30 and December 31st of each year and mature on December 31, 2031. Each $1,000 bond is convertible, at the bondholders’ option, to 15 common shares. Bonds with similar maturity dates and interest payment, with no conversion option were priced to yield 6.0% on January 1, 2011. Going through the junior accountant’s work, you discovered the following journal entries relative to the bonds. The debit to cash is the correct amount of cash proceeds received (ignore transaction costs for this issue). These entries have all been posted, and are included in the balances on the draft financial statements.

Date Account DR CR

Jan 1, 2011 Cash $8,000,000

Bonds Payable $8,000,000

June 30, 2011 Interest Expense $200,000

Cash $200,000

Dec 31, 2011 Interest Expense $200,000

Cash $200,000

4. On April 1, 2011, Kaska Ltd. issued 100,000 common shares at the market price of $18.46 per share. As of December 31, 2011, there were 1,245,000 common shares issued and outstanding. The average market price of the shares for 2011 was $19.40.

5. The note payable was taken out on January 1, 2009. The terms of the note are:

• The note is payable in 10 equal installments of $425,000, plus interest on January 1 of each year.

• 3.00% interest is calculated based on the balance outstanding at December 31; for example, the December 31, 2009, balance would be used to calculate interest to be paid on January 1, 2010.

6. On June 1, 2011, Kaska Ltd. purchased 35% of the shares of Majestick Mining Supplies Ltd., their major supplier. Majestick Mining is a Canadian corporation and, at that time,the carrying value of the assets and liabilities of Majestick was equal to their fair value. Majestick has a September 30th year-end, and for the year ended September 30, 2011, reported a net income of $1,450,000. Majestick declared total cash dividends to common shareholders in the amount of $850,000 on December 1, 2011, payable January 31, 2012. The only entry you can find related to the investment is the original purchase of the shares.

7. The bookkeeper had decided to switch from the allowance method of accounting for bad debts to the direct write-off method. An entry was made on January 1, 2011, that reversed the opening balance in the allowance account to bad debt expense. On December 31, 2010, the allowance account had a normal balance of $30,500. During 2011 a total of $40,175 in accounts receivable were written off. The entry to record this write-off was to debit Bad Debt expense and credit Accounts Receivable. When you reviewed previous years’ transactions, you determined that 7.0% of Accounts Receivable should be recognized as potentially uncollectible.

8. On January 1, 2011, Kaska Ltd. set up 75,000 stock options for 10 of their key executives. The option plan allows the executives to purchase shares for $15.00 each. The Black-Scholes value of this plan was determined to be $2,000,000 on January 1, 2011; the options will vest in 5 years. It is estimated that 90.0% of all eligible employees will still be employees of Kaska Ltd. when the vesting period ends. No entries were made during the year related to this plan.

9. On July 1, 2011, Kaska Ltd. renewed their annual general insurance policy and paid a premium in the amount of $400,000. This amount is reported as Prepaid expense. The policy expires June 30, 2012.

10. “Other Liabilities” include the following amounts:

• Estimated 2011 year-end accounting and audit fees, the estimate of which was provided by the external auditor, in the amount of $20,000.

• Payroll deductions for the December payroll costs in the amount of $22,500 which is due to be paid on January 15, 2012.

• Kaska Ltd. has a defined contribution pension plan and the 2011 contribution is due to made on January 1, 2012. This amount is $432,500.

• Year end executive bonuses due to be paid January 31, 2012 in the amount $650,000.

11. On May 1, 2011, Kaska Ltd. leased a model 780J mining truck. The lease term is 8 years with annual payments of $672,390 due each May 1st, with the first payment having been made when the lease was signed. At the end of the lease term, Kaska has the option to purchase the truck for $400,000. It is estimated that the truck has a useful life of 12 years at which point the salvage value is estimated to be $100,000.

12. On December 31, 2010, the UCC balances for Kaska’s various assets were as follows:

Asset Class Rate UCC

Equipment 8 20% $5,687,500

Building 6 10% $960,000

For purposes of this case only, assume there are no differences between accounting and tax balances on any mine resource amounts. There were no additions or disposals during the year other than the lease of the 780J (considered a Class 8 asset). Kaska Ltd. uses straight-line depreciation for all assets, other than the mine, which is depleted using units of production method.

13. The administrative expense amount includes $25,000 in meals and entertainment expense, and $10,500 in membership dues to a local golf club and resort that is used exclusively for executives and clients.

14. The advertising expense is all related to Canadian publications and media; however, one-half of the amount reported is not deductible for tax purposes until 2014.

15. One of the journal entries recorded by the bookkeeper on December 31, 2011, reallocated the opening balance in the deferred tax account to retained earnings. The explanation given for this entry was that as the deferred taxes related to prior years' income and expenses; they should be reallocated to retained earnings.

16. The income tax expense reported on the draft income statement is equal to the installment payments that were made during the year. The tax payable is the amount of the final installment that was to have been made on December 31, 2011.

17. The mine was purchased on June 30, 2007, for $95,000,000 at which time it was expected to yield 4,750,000 tonnes of material. A review of the mine records for that period of time yielded the following information:

2007 2008 2009 2010 2011 Total

Tonnes mined 300,000 495,000 544,500 600,000 660,000 2,599,500

Depreciation amount $6,000,000 $9,900,000 $10,890,000 $12,000,000 13,200,000 $51,990,000

Tonnes sold 270,000 445,500 571,725 630,000 660,000 2,577,225

When Kaska purchased the mine in 2007, it was estimated that in 15 years when the mine was fully depleted, $15,000,000 would have to be spent to restore the mine site to its original pristine condition. The only entry you have been able to find that relates to the retirement obligation is a credit to

Retained Earnings and debit to Future Restoration

Costs in 2007 for $15,000,000. No other entry or disclosure has been made for this obligation.

Required:

1. Assuming that this is the only information you have available, prepare the necessary journal entries to adjust, correct and complete the December 31, 2011, year-end for Kaska Ltd. You may add whatever additional accounts you deem to be necessary. Journal entries will include a full explanation of why the adjustment or correction is required and a brief explanation of how the calculation was completed.

2. Prepare a revised set of financial statements, excluding the Statement of Cash Flows for Kaska Ltd. incorporating your entries from Requirement 1.

3. Calculate the basic and diluted EPS for Kaska Ltd.

4. Without preparing the actual Notes to the Financial Statements, list and briefly describe the minimum note disclosure required by Kaska Ltd. You are not required to describe the note outlining the various accounting policies followed by Kaska Ltd. or any note disclosures specific to the Statement of Cash Flows.