Case Scenario:

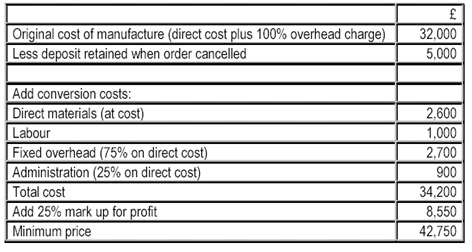

A firm of ship builders has just had an order for a small vessel cancelled after it had been produced. The only potential buyer is now a foreign government which has said that it might buy the vessel if certain conversion work were done in one month. The following price schedule has been submitted to help management decide the minimum price that could be charged to the foreign government.

Price estimate:

The following information is available:

The material originally used in the construction of the vessel was of two types:

• Type one could now be sold to a scrap merchant for £2.000. but it would take 60 hours of labour. paid 50p an hour. to put the material in a suitable form for the sale: the work would be undertaken by the firm's maintenance department. which is very slack at this time.

• Type two material could be sold to the scrap merchant for £1.500. again after 60 hours of labour had been spent on it by the maintenance department. Alternatively. it could be kept for use next year as a substitute for a material which is expected to cost E2.000: 120 hours of highly-skilled labour would then have to be hired at 75p per hour to render the material suitable for use.

The material that would be used for the conversion was ordered a year ago at a price of E4.200. Delivery was delayed. and its realisable value has fallen to £1.000. In recognition of this. the suppliers have given the firm a discount of E1.600. The material could be used only for this one job. since the job it was going to be used for has been cancelled and there are no plans to continue that line of activity.

Labour for the conversion will be temporarily transferred from another department for four weeks. This other department could continue operating and its weekly contribution to overheads and profits could be maintained at 75% of its normal level of £5.000 if a special machine were hired to help replace the missing labour. The total cost of hire would be an additional E1.500. The plans. patents and specifications of the vessel could be sold for £1.750. if the vessel were not sold.

Overheads:

• Additional supervisors. etc.. would have to be hired for £900 for the conversion. It is the firm's practice to charge such costs to administration overheads.

• The firm's fixed overhead rate covers depreciation (on a straight line basis). staff expenses and lighting. The depreciation charge in the above schedule for conversion is £700. In fact. only hand tools will be used in the conversion. No other overheads will be affected by the conversion.

The mark-up for profit has been reduced from the firm's normal 50% because this rate is unlikely to be obtained in this case.

Required:

• In order to calculate the minimum acceptable price based on opportunity cost principles. show how you should deal with all the figures in your calculation.

• What are the implications of your calculations for management decision making?