Case Scenario: “Reed Park, Inc.”

Reed Park, Inc., is a bottler/supplier of bottled spring water to both commercial and residential customers. Reed Park's corporate headquarters is located in Clearwater Springs, Colorado. It operates distribution centers (DCs) in three territories throughout the metro Clearwater Springs area. The company began by selling to residential areas and small businesses in the region. In recent years, its sales have moved toward larger businesses. The Metro center was the first DC established. The newest center, Metro West, was established four years ago and continues to show great growth potential.

Bottling and distribution operations are treated as separate entities, and the costs associated with each are easily tracked and charged to the appropriate division. There have been no problems between the two divisions related to the accounting systems. However, the managers in the distribution division have recently begun raising some questions regarding the accounting systems in place within their division.

Distribution center operations are relatively straightforward. Bottled water shipments are taken from the main bottling plant and stored at the DCs for delivery to customers at later dates. Most subscribing customers take delivery once every two weeks. Expenses associated with DC operations can be seen in the quarterly income statement (Table 1). DC overhead includes lease, building maintenance, securiry and other costs related to running the warehouse facility. Staff and administrative expenses include salaries of sales and support staffas well as the cost of office supplies used in running the office.

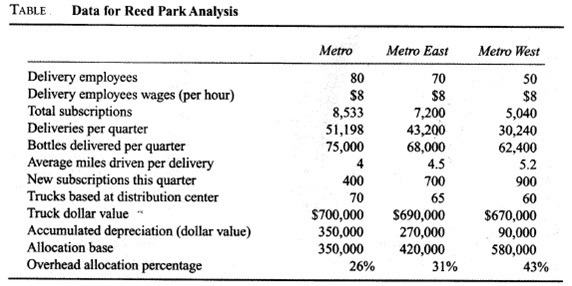

Each distribution center has its own sales staff. The corporate office handles the subscription process and provides the drivers/delivery employees the information regarding delivery type and schedule. The majority of corporate overhead allocated to distribution centers results from the processing and maintenance of subscriptions and schedules. Reed Park allocates these overhead costs based upon the proportion of the book value of trucks at each DC facility to the total book value of the entire Reed Park delivery fleet. This allocation method was implemented at the time the company was founded to relate costs to the most significant cost item. Trucks are requested by distribution centers and purchased by the corporate offices under a corporate fleet contract with a major truck manufacturer. (See Table 2 for relevant data.) Each DC is treated as a profit center and DC management is evaluated based upon its territory's net income performance.

The bottled water industry is experiencing strong growth, as is Reed Park. While Reed Park's business seems to be profitable, all is not well within the ranks of the organization. Corporate has been pressuring DCs to expand their territories and increase delivery volume, but DCs have been reluctant to meet this request. Some DC managers are beginning to question the amount of overhead being charged to them. They complain that increased deliveries will only cause overhead costs to rise. DC drivers are also unhappy; they complain about being overburdened by their ever-expanding routes and the pressure to meet difficult delivery schedules. Steve Austin, assistant to the controller, has been assigned the task of examining the situation and developing alternatives if, indee4 a solution is needed.

Required:

Q1. Describe the problems, if any, at Reed Park. Specifically, discuss items related to decision making, cost allocation, and incentives.

Q2. Describe alternative overhead allocation systems.

Q3. Which allocation system would you choose? What effects do you feel it would have upon Reed Park's distribution operations?

Q4. Calculate net incomes for the three DCs under the system you have chosen and compare these results with those found under the present system.