Question 1: Greg has negotiated a $20,000 price on a new pick-up truck. The manufacturer is offering a $1,500 rebate or 3.9 %, three-year financing. Greg is also able to get 7 %, three-year financing at his credit union. If Greg plans to finance $18,000 over three years, should he take the rebate or the 3.9 % financing? (Show all work.)

Question 2: Judy has $2,000 for a down payment on a vehicle and she can afford monthly payments of $400. She wants to finance a vehicle over no more than 4 years. If lenders are currently offering 6 percent interest on 5-year loans, what is the maximum price Judy can pay for a vehicle?

Question 3: Your mortgage payment is $1,500 per month. Of this amount, insurance is $50, property taxes are $200, and interest is about $1,100. Assuming you have other itemized deductions that already exceed your standard deduction and that you are in the 31% marginal tax bracket, what is the reduction in your tax liability as a result of owning a home with this mortgage. (Show all work.)

Question 4: Dick and Jane (and their dog Spot) have just purchased a house and are calculating how much money they will need when the closing day rolls around. The purchase price is $200,000. They will make a 20% down payment, and they must pay 2 points on the loan. Closing costs should be 3% of the purchase price. What is the total dollar amount they will need at closing? (Show all work.)

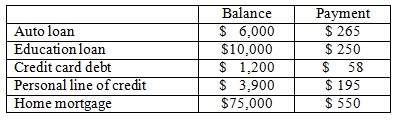

Question 5: Christine just finished her first year of work following graduation, and she feels it is time she assess her financial situation. Her annual gross income is $45,000, and her income after taxes is $35,800. She has the following liabilities. What is Christine's debt safety ratio, and what does it say about Christine's financial situation?

Question 6: Calculate the finance charge and the monthly payment on a $20,000 add-on installment loan with an interest rate of 9% and a term of 5 years. (Show all work.)

Question 7: Downward Motors has offered Vicki either a $2,500 rebate or a 2%, 4-year loan on the new SUV she is purchasing for $33,000 with a $3,000 down payment. Vicki has done her homework and knows that she can get a 6%, 4-year loan at his credit union. Should Vicki take the rebate or the 2% loan from the dealer? (Show your key strokes.)

Question 8: You have inherited $250,000. You have decided that since you don't need the money currently, you should invest for the long-term. After seeking advice, you decide on an asset allocation plan that puts 10% in short-term securities, 75% in equities, and 15% in bond funds. How much money would you put in each category? (Show all work.)

Question 9: You have just bought 100 shares of ABC Corporation common stock at 70.50. The commission is calculated as 1.5% of the total value of the transaction plus $30. What commission will you be charged and how much must you pay the broker for the entire transaction? (Show all work.)

Question 10: Julie's employer has a defined benefits retirement plan which pays 3.2 percent of her last year's salary for each year of employment. Julie estimates her final salary will be $85,000 and she will have worked for 20 years. What is her expected retirement benefit? (Show all work.)