Question 1:

Amanda White has started a domestic cleaning business Spotless View Cleaning (SVC). She started the business on 1st May 2013, it is now 30th June and she has asked for your assistance in preparing her financial statements. On 1st May Amanda deposited $5,000 into a new bank account opened in the name of the business. The $5,000 consisted of a $2,400 interest free loan from her father and $2,600 of her own money.

Amanda rented some equipment from Barry’s Equipment Hire. On 1st May, she signed a four-month rental agreement on cleaning equipment (vacuum cleaners and a floor polishing machine) and paid $400 for the four month rental period. On the same day Amanda also purchased (for $3,000) an old van to be used exclusively for the business. She believes that the van has three years of useful life and then will have a resale value of $300.

Amanda has made a note in her diary whenever she has taken items from the business for her personal use. At 30th June she consults her diary and calculates that she has taken $950 cash and $20 worth of cleaning supplies during the period.

The loan made by her father is to be repaid in twenty four equal repayments. Each repayment is made on the last business day of the calendar month. Normally all of the work done by SVC is performed on account but one domestic customer insisted in paying in cash at the time the work was done. The customer paid $120 and Amanda decided that it was not worth producing an invoice for an amount which had already been received. All work done during the period has been invoiced. Invoices totaling $8,300 had been issued.

At 30th JuneAmanda’s customers owe her $900. Herdiary records list payments for supplies totaling $380, and at the end of the period she still has supplies that cost $60 on hand. She paid her employees $2,900, and still owes them $320 for their final week of work. During June Amanda paid her mobile telephone bill of $280 from her personal bank account. She estimates that 60% of the calls made were for the business purposes. She also has an unpaid bill for $125 from Keen Maintenance for a repair made to her floor polishing machine.

Required:

You must clearly show how you have calculated each amount shown on the statements, either by writing it next to the account name, for example Sales ($5 x 2,000) or by referencing the amount using a, b c etc. and putting your calculations for each of these at the bottom of the statement. For example, Sales (a) and then at the bottom of the statement put (a) and your calculation. Statements provided without calculations/explanations will receive no marks.

a) Prepare the business Income Statement for the period.

b) Prepare the Statement of Changes in Equity for the period.

c) Prepare the classified Balance Sheet at the end of the period.

Question 2:

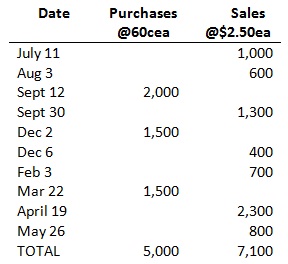

Mary is a student and also operates a part time business called Jano Enterprises. She sells imported marker pens to various retail office and stationery supply shops. Business commenced in May 2012.Mary conducts all of the business’ operations (she works alone and has no employees).

Mary purchases pens for 60c each and sells them for $2.50 each. These amounts have not changed since Mary started operations.

At 1st July 2012 an amount of $1,500 appears as inventory in the trial balance.

During the year ended 30th June 2013, Mary made the following unit purchases and sales.

On 30thJune 2013(the end of the accounting period), Mary counted 370 pens remaining on hand.

Required:

a) Calculate the Gross Profit for the year ended 30th June 2013 under both the (i) perpetual and (ii) periodic methods of inventory recording by providing a correctly formatted extract (up to gross profit only) from Jano Enterprises income statement. You must also provide explanations and calculations for each amount shown on the statement extracts. Present this information below your statement extract. Statements provided without calculations and explanations will not receive marks.

b) Of the two methods used in 1. Above, which method (if any):

i. Provides the higher Gross Profit figure?

ii. Provides the most information for control purposes, and how?

iii. Considering the circumstances, which inventory method would be the most appropriate for Mary’s business? Explain why.

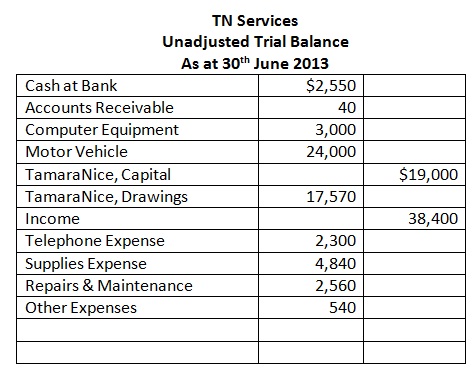

Question 3:

Tamara Nice set up a secretarial services business (TN Services) on 1 July 2013. Usually, Tamara collects $20 per hour for services provided on the completion of each day's work and pays for the maintenance of her computer equipment with cash. Tamara did an accounting subject at secondary school and so has kept her own accrual-based accounting records. At the end of the first year, Tamara produced the following unadjusted trial balance:

The following adjustments were required at the year-end:

• Supplies on hand at year-end, $230.

• An account was received for repairs done to Tamara’s computer equipment before year-end but not recorded, $270.

All calculations must be shown. Solutions provided without calculations will not receive marks.

Ignore the GST in your answers.

Required:

a) Prepare an income statement for the year ended 30th June 2013 using accrual accounting.

b) Prepare an income statement for the year ended 30th June 2013 using cash accounting.

c) Tamara was not sure whether she could use cash accounting rather than accrual accounting for her business records. From the information provided, decide whether Tamara should use accrual or cash accounting, and explain to her the reasons for your decision.

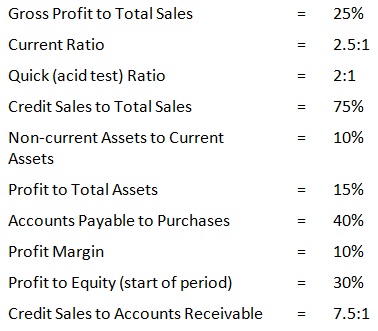

Question 4:

The following values relate to various ratios determined for a sole trader, Ben Bournemouth, for the year ended 30 June 2013. At that date, the total assets in the Balance Sheet were $900 000. The ratios relate to the accounts either in respect of the 12-month period or at the date of the Balance Sheet for the end of the period.

Required:

Assuming that there are no prepaid expenses and that accounts payable are the only liability, and rounding answers to the nearest dollar, prepare:

a) A detailed Income Statement for the year ended 30 June 2013, including an itemized cost of sales calculation (assuming a periodic inventory system).

b) The business’ Balance Sheet as at 30 June 2013.