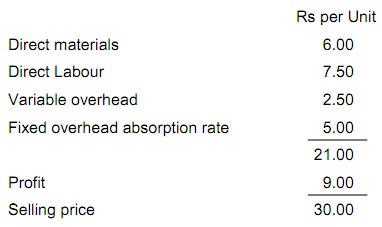

Question 1: Big Woof Co. manufactures a single product, Z. Cost and selling price details for product Z are as illustrated below:

The given additional information is as well available:

Budgeted production for the month was 5,000 units though the company managed to generate 5,800 units, selling 5,200 of them and incurring fixed overhead costs of Rs 27,400.

Required:

a) Compute the marginal costing profit for the month.

b) Compute the absorption costing profit for the month.

c) Describe how closing inventories are valued beneath marginal costing and absorption costing?

Question 2:

a) Data concerning a company’s single product is as shown below:

Rs per Unit

Selling price 6.00

Variable production cost 1.20

Variable selling cost 0.40

Fixed production cost 4.00

Fixed selling cost 0.80

Budgeted production and sales for the year are 10,000 units.

Required:

a) Find out the company’s breakeven point, to the nearest whole unit?

This is now expected that the variable production cost per unit and the selling price per unit will each rise by 10%, and fixed production costs will increase by 25%.

b) What will be the new breakeven point, to the closest whole unit?