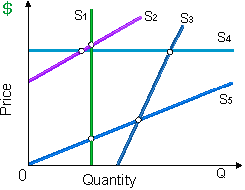

Suppose that all these demonstrated curves are infinitely long straight lines. So, a supply curve for that price elasticity of supply is constant for each possible price and quantity is: (i) supply curve S2. (ii) supply curve S3. (iii) supply curve S5. (iv) none of the above.

Can anybody suggest me the proper explanation for given problem regarding Economics generally?