ECONOMICS

Explain why each of the following statements is True, False, or Uncertain according to economic principles. Use diagrams where appropriate. Unsupported answers will receive no marks. It is the explanation that is important.

A4-1. Pure public goods like national defence tend to be underprovided by the market because people see little benefit in national defence.

A4-2. Free entry is necessary for efficient production in a fishery (ie. the use of a particular stock of fish).

A4-3. Suppose a project will cost $300 to be shared equally between 3 citizens (X, Y, and Z). The benefits will be +150 for X, +120 for Y and +10 for Z. Majority voting on the project will result in an inefficient decision.

A4-4. Suppose income taxes (T) as a function of income (Y)are given by T(Y) = X + 0.4Y. If X = 0 the tax is proportional, while if X < 0 the tax is progressive.

A4-5. If the government wants to transfer a certain amount of money to the poor in society, then, even if the cost of administration were zero, the cost to the economy would be greater than the amount transferred.

A4-6. The unemployment rate in the US has decreased over the last year. Critics of current US policy have pointed to the number of "discouraged" workers as being responsible and that the labour market there has not really improved. These critics may be right.

A4-7. If the CPI increases from 110 to 121, the inflation rate is 10%. So a nominal interest rate of 12% implies a real interest rate of 2%.

A4-8. Over the last 3 months the Euro has appreciated against the US dollar from about 1.30US/E to about 1.33US/E. Over the same time period, the Japanese Yen has depreciated against the US dollar from about 80Y/US to about 90Y/US. If exchange rates are consistent we can be sure that the Euro has appreciated against the Yen.

A4-9. Suppose the marginal external cost of emissions of a certain substance is equal to $30 and the marginal costs of emissions abatement (MCA) for the substance is given by: MCA = A.

(a) Explain why the marginal benefit to emissions abatement (MBA) is equal to $30. What is the efficient level of abatement? Illustrate in a diagram.

(b) Assume that the maximum amount of emissions is 50 units. What is the deadweight loss at zero abatement? What is the deadweight loss at 50 units of abatement?

(c) Suppose that the conditions exist such that the Coase Theorem will work (ie. costless negotiation between the polluter and the bearer of the external cost). Explain why the efficient amount of abatement will result if either the polluter or the bearer of the external costs is given the right to decide the level of abatement.

(d) Assume now that negotiation is impossible. Suppose that there are two firms that are equal emitters of the pollution and that the marginal costs of emissions abatement (MCAs) for firms 1 and 2 are given by:

MCA1 = 3A1 MCA2 = (3/2) A2

(Note that horizontally summing these two functions leads to the overall marginal cost of abatement function used above.) Calculate the efficient allocation of abatement.

(e) Suppose that, in the absence of regulation, each firm would emit 25 units of pollution. If a regulator assigns each a non-transferable allowance of 10 units of emissions, how many units of abatement will each firm undertake? Calculate and illustrate the inefficiency of this solution.

(f) Now suppose that the regulator assigns each firm transferable permits for 10 units of emissions. What would be the equilibrium price of a permit after trade has taken place? What would be the allocation of abatement?

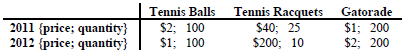

A4-10. Suppose that, in 2011 and 2012, the people of Wimbledonia consumed only three goods. The average representative consumption bundles and good prices in the two years are as shown below:

(a) What is the percentage change in the price of each of the three goods? Do tennis racquets become more or less expensive relative to Gatorade?

(b) Calculate the consumer price index for each year using 2011 as the base year. What is the percentage change in CPI (the inflation rate)?

(c) The CPI is often interpreted as the change in the "cost of living". Explain why not all of the people in the country are likely to be equally affected by the price changes.

A4-11. Germany is likely entering, or is already in, a recession. What do you expect to happen to real national income and in its growth rate over the next few months or quarters? What about potential output? What should happen to the output gap? Finally, what do you expect to happen to the unemployment rate? Explain.

The material in this assignment is copyrighted and is for the sole use of students registered in Economics 110, 111 and 112. The material in this assignment may be downloaded for a registered student's personal use, but shall not be distributed or disseminated to anyone other than students registered in Economics 110, 111 and 112. Failure to abide by these conditions is a breach of copyright, and may also constitute a breach of academic integrity under the University Senate's Academic Integrity Policy Statement