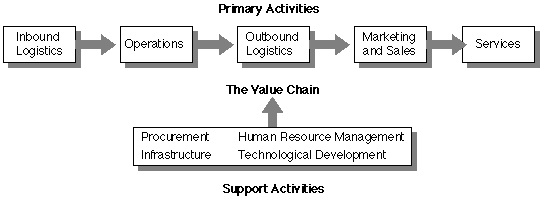

Value Chain: The value chain is a theory from business management that was first described and popularized Michel Porter in his 1985 best seller, Competitive Advantage: Creating and Sustaining Superior Performance.

Porter’s idea of value chain is based on the process view of organization. It sees the manufacturing organization as a system made up of subsystems each with its inputs transformation process and outputs. All the three facets in each subsystem involve acquisition and consumption of resources such as man, machine, material, method, plant, administration etc. The method of performing these activities determines the costs and profit margin of the firm as each firm has to accept the market sales price. Porter has identified following primary and secondary activities.