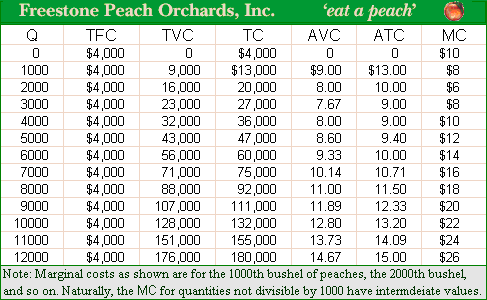

This purely competitive peach orchard would most likely exit this industry within the long run when the wholesale price per bushel of peaches fell below: (i) $9.00 per bushel of peaches. (ii) $10.00 per bushel of peaches. (iii) $11.00 per bushel of peaches. (iv) $12.00 per bushel of peaches. (v) $13.0 per bushel of peaches.

Hey friends please give your opinion for the problem of Economics that is given above.